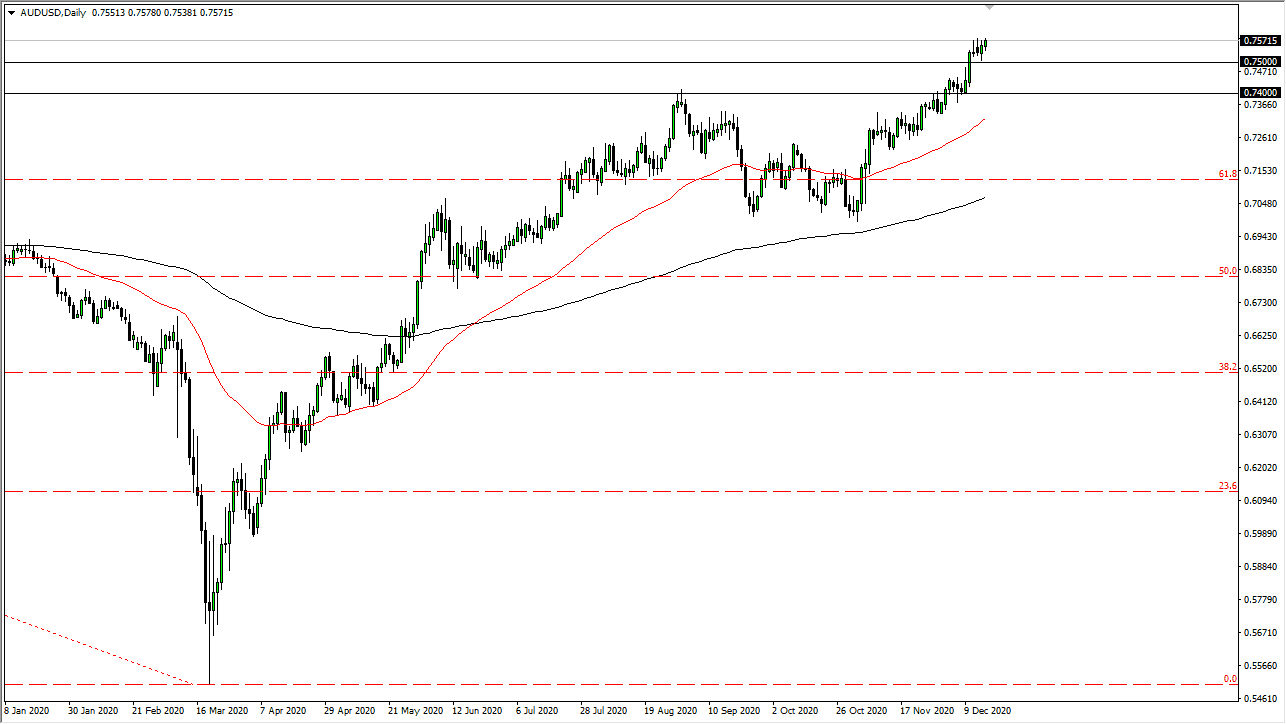

The Australian dollar continues to rally, after initially pulling back during the day on Wednesday. The Aussie continues to rally in general against other currencies as well, so it makes sense that it would do quite well against greenback. After all, the greenback is currently being worked against by its central bank and the idea of stimulus coming out of the United States. The market is likely to continue seeing value hunters come back into the market, with the 0.75 level offering support extending down to the 0.74 level.

The market is clearly in an uptrend, so buying short-term pullbacks has been a significant way to make money in this pair. Overall, we are going to go looking towards the 0.7750 level, but we need to see stimulus passed in the United States to give a bit of a boost to this market to go further. It is unlikely that we will continue seeing buyers come in to pick up bits and pieces of value, and the stimulus talks suggest that perhaps we could be looking at a higher Aussie mainly because the US dollar has been beaten down. Furthermore, commodities tend to be highly levered to the Aussie dollar, so I think this trade makes sense.

The market is also paying attention to the 50-day EMA that is reaching towards the 0.74 handle, so buyers will eventually come back in on any dip. Keep in mind that the Friday session is going to be “quadruple witching”, which is a very noisy day in general, as options expire in four different asset classes. This can have an effect on the commodity and currency markets, so the Australian dollar could certainly suffer at its hands. However, in time, we will finally break out to the upside. The next couple of days should see stimulus talks progressing even further, and as soon as we get a resolution, that will probably be another reason for this market to make another push higher. We are a little extended, though, so the occasional pullback does make sense.