The Australian dollar pulled back a bit during the trading session on Tuesday, as we continue to see a lot of volatility in the markets in a relatively tight range. It is not just the Australian dollar, but the Forex markets in general. This can be due to the US dollar, but it can also be due to the nonsense that is going on in the never-ending drama that is Brexit.

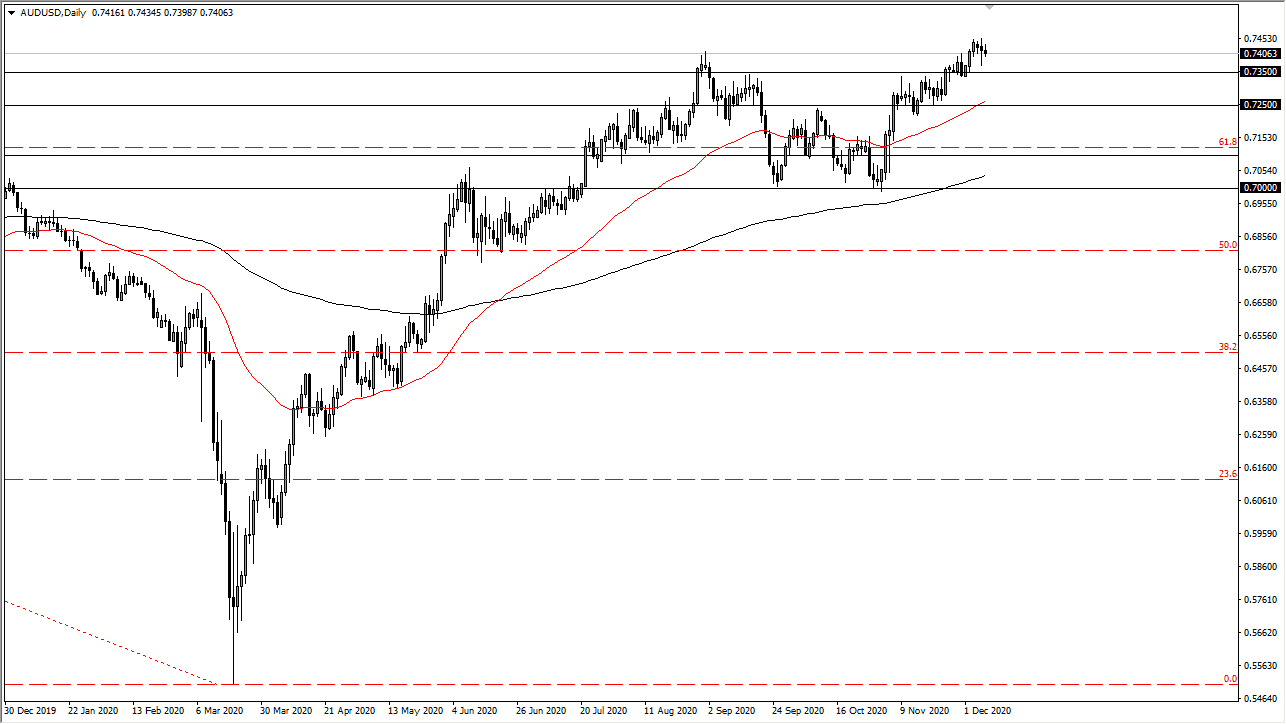

It is possible that we are looking at a complete “risk on/risk off” situation. The market is likely to see a lot of choppiness, but the overall attitude of the Australian dollar rallying again makes sense as we continue to see central banks around the world eviscerate their own currencies, especially the Federal Reserve. Furthermore, gold markets will be watched, because if gold suddenly start to take off, Forex traders may use the Australian dollar as a proxy. I think there is a significant amount of support between the 0.7350 level and the 0.7250 level. The 50-day EMA approaching that level helps as well.

I have no interest in shorting this market, because traders will start to focus on liquidity measures by the Federal Reserve as well, and the coronavirus figures continue to get worse in the United States. However, the massive amounts of stimulus that are very likely to come out of America and other places around the world should favor the Australian dollar as it is so highly linked to commodities. The idea is that we are going to see a bit of a “reflation trade”, and that should have people looking to trade other markets such as copper, aluminum, tin, gold and silver. We should continue to see more of an upward pressure in this market. Keep in mind that the 0.75 level above is massive resistance, not only on the daily chart but most certainly on the weekly chart. If we can break above there, then the Australian dollar is likely to go much higher, probably towards the 0.80 level.