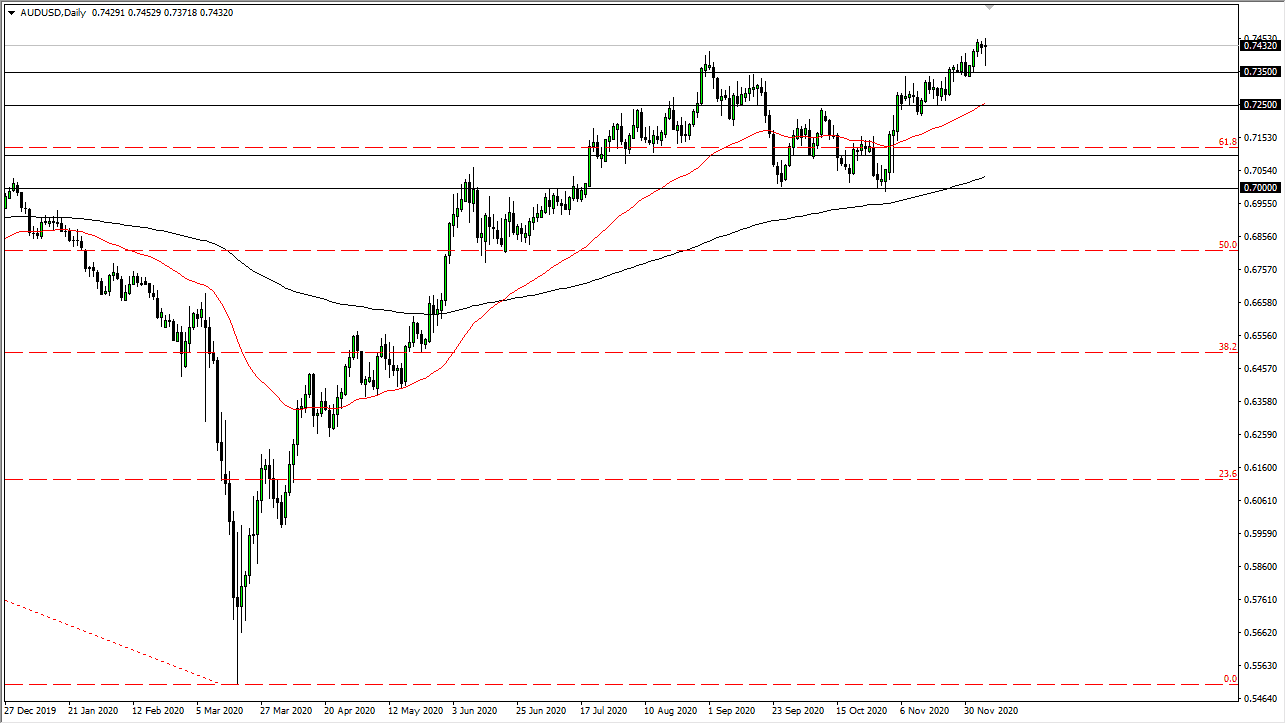

The Australian dollar initially pulled back during the trading session on Monday, but continues to look very bullish as we see plenty of buyers on these dips. In fact, by the end of the session, we did up forming a hammer. The 0.7350 level has offered support, an area that previously was massive resistance. The fact that we have pulled back there only to find buyers is a perfect example of “market memory”, and as long as we have more of a “risk-on” type of move ahead of us, it is likely that the Australian dollar will be one of the bigger beneficiaries.

The US dollar has had major issues as of late, and we are likely going to continue to see that be the case. After all, the US dollar is suffering at the hands of massive quantitative easing and the so-called “reflation trade.” This is a trade in which we start to bank on stimulus coming out of places like the United States, and thus a higher demand for commodities. These commodities are quite often reflected in the Forex markets with the Australian dollar, which is what we are seeing here. The 0.7450 level has been tested during the day, but I think we will go looking towards the 0.75 handle. Breaking above that level would be a major turn of events and could kick off the next leg higher.

I do not have any interest in shorting the Australian dollar, at least not anytime soon, considering that it has been so strong for so long. I believe that the 0.7350 level will continue to be supported, but I also think that support extends down to the 0.7250 level where we also see the 50-day EMA. Buying dips continues to be the best way forward, as the buying has been relentless and we continue to see plenty of people looking to get involved in the potential longer-term move to the upside. Because of this, I think we will also continue to see plenty of opportunities in the short-term charts, but eventually it is possible that we will go looking towards the 0.80 level once we finally get above that 0.75 handle. I have no interest in shorting.