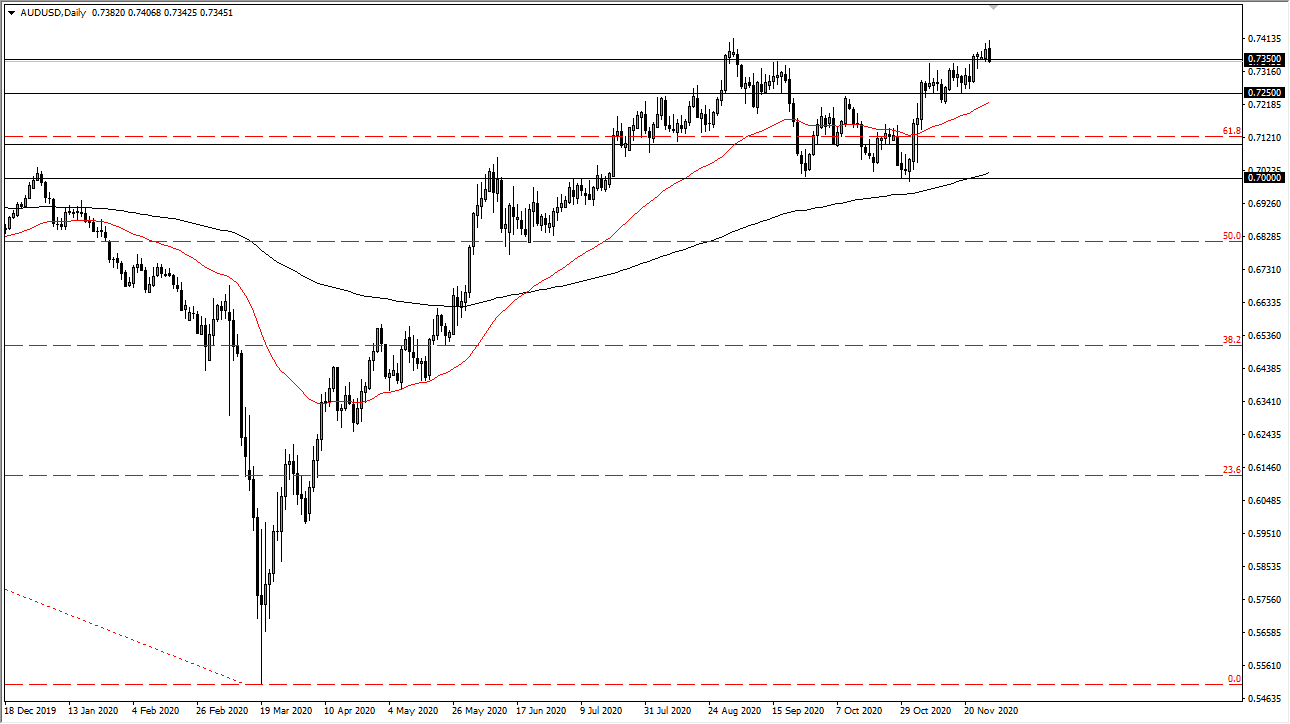

The Australian dollar initially tried to rally during the trading session on Monday, but gave back the gains as the highs seemed a bit too much. The market will continue to hear a lot of noise, but there is plenty of support underneath extending all the way down to at least the 0.7250 level. There is a massive previous “resistance barrier” in that general vicinity, so there will be plenty of buyers. This is a market that moves based on risk appetite, which got absolutely killed on Monday.

Part of the problem may be end of the month outflows by large funds that have to recycle gains from big winners. Because of this, the day may have been a bit skewed, but at the close of the session it does not really matter what the reason was. The reality is that we were lower and looked very vulnerable all of a sudden. Nonetheless, there are plenty of support levels underneath, so I any weakness will probably only last a session or two. You should be looking for value in order to take advantage of what has been relatively strong movement by the Aussie dollar.

The 50-day EMA is sitting just below the 0.7250 level, so it should continue to offer a bit of emotional support if nothing else. This market is in a bullish trend, and therefore has formed a “W pattern.” What we are seeing is the beginning of an attempt at a serious breakout. Whether or not it does happen in the short term is a completely different question. The upside is kept somewhat pressured by the 0.74 handle, but eventually we will break through there. You may have to be a bit patient and recognize that the Non-Farm Payroll numbers come out on Friday, so between now and then we could see a bit of choppy behavior. Nonetheless, we have been in an uptrend for a long time, so there will be plenty of value hunters out there looking to pick this market up. The US dollar continues to fight a Federal Reserve that is intent on flooding the market with it.