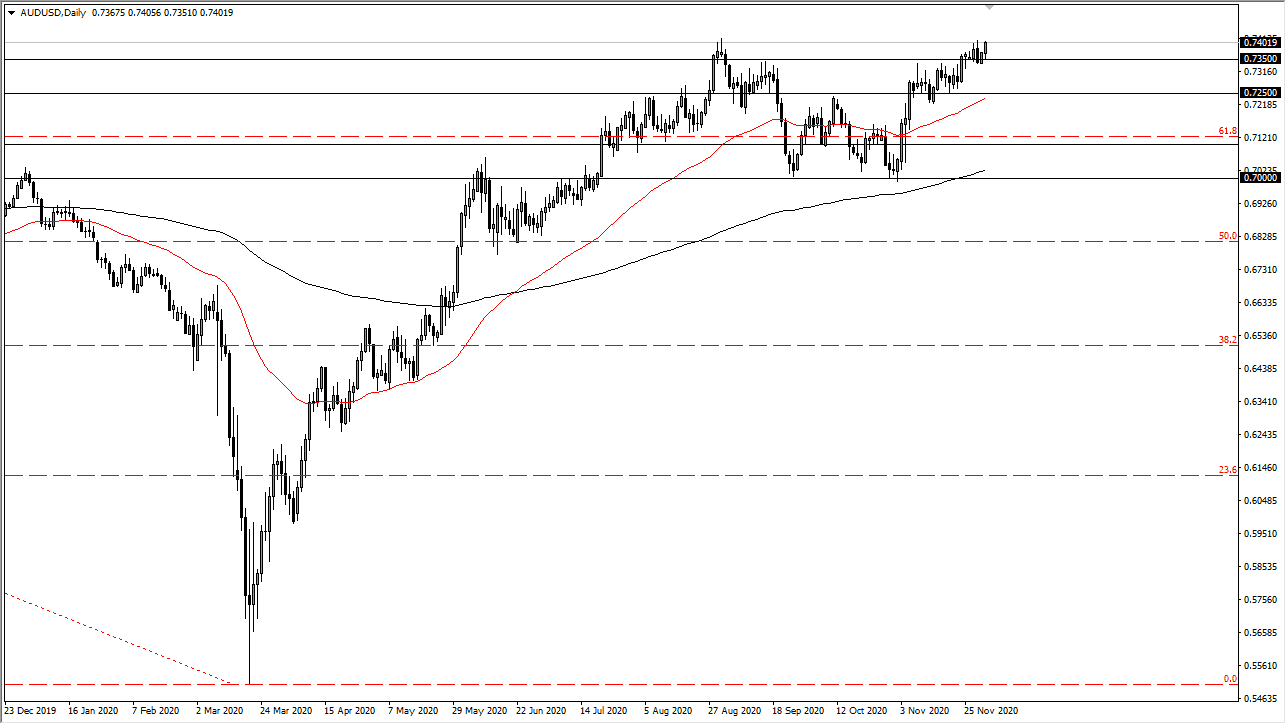

The Australian dollar initially pulled back during the trading session on Wednesday to test the 0.7350 level for support. It did find it there, and by the end of the day started to reach towards significant highs yet again. This is a market that will take off to the upside given enough time, as we have been building pressure for quite a while. We have formed a massive “W pattern”, just as we did in the EUR/USD pair. However, the euro has broken out, so it is possible that the Australian dollar will try to play catch up at this point.

I believe in buying short-term pullbacks, because the Australian dollar is highly sensitive to economic expansion as well as the depreciating US dollar, which continues to be a major issue. I do like the idea of buying short-term dips and eventually holding on for a move towards the 0.75 handle. Furthermore, the market is likely to see that the US dollar has many problems ahead as stimulus and monetary policy expansion in the United States unfold, which should continue to push to the upside.

To the downside, the 50-day EMA underneath should be massive support near the 0.7250 level. The market had previously seen a significant resistance barrier of 100 pips, so it should now offer plenty of support. The Australian dollar will find its way higher. However, if we get a major “risk-off event”, that could send this market back down towards the bottom of the range and looking for the 50-day EMA.

Now that we have closed as high as we have, it is going to be very difficult to start shorting anytime soon. The market is likely to try to kick off the next leg higher and, when you look at the longer-term charts, we have been digesting for a while. This is a matter of when, not if, the Australian dollar takes off to the upside. The 200-day EMA has now crossed the 0.70 level, so we have to break down below there to think about shorting.