The US dollar has been sold off against everything, so the Aussie gaining should not be a huge surprise. That being said, this is also a market that is highly sensitive to the idea of commodities and stimulus, so with all that being correlated so tightly, it does make sense that perhaps the Aussie sees a bit of strength and a possible move to the upside as a result.

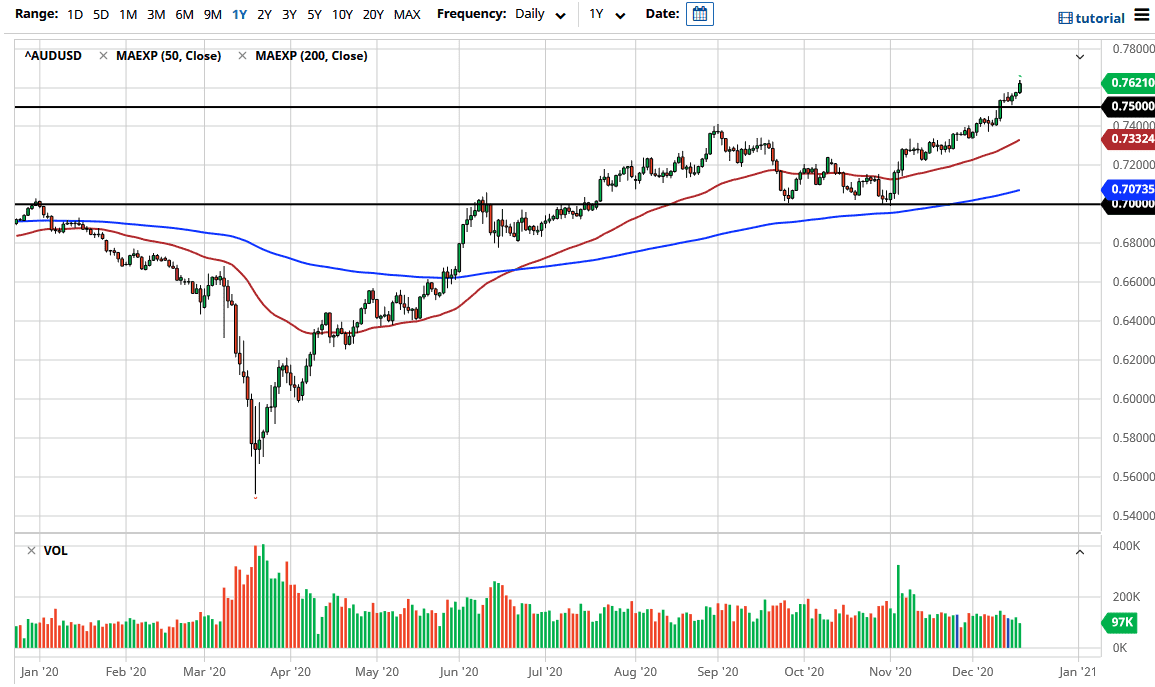

The idea being that stimulus will devalue the US dollar, so that of course works in favor of the Aussie, but beyond that you also have to keep in mind that we probably see demand for commodities pick up, and the Aussie tends to be very sensitive to the so-called “hard commodities”, such as copper, iron, and aluminum. It also tends to attract gold, which of course rallies when the US dollar falls. All these things being equal, it does suggest that we are going to go higher given enough time. I do not have any interest whatsoever in trying to short this pair and I think that the 0.75 level will continue to be support. After all, it was significant resistance and we have already tested it to see whether or not there was a sign of “market memory.”

I believe that given enough time we should continue to go looking towards the 0.7750 level, which has been my target for a while. I think that if we do get a short-term pullback during the trading session on Friday, it will probably be a buying opportunity on Monday so I will simply look for value if it occurs. Otherwise, if you are already long of the Aussie like I am, it is possible that you can simply hang on to the position although the weekend could bring a few nasty surprises so be aware of this. It is not to say that anything would denigrate the value of the Aussie right away or directly, but there could be a bit of safety seeking if politicians act like children over the weekend again, which is always a real threat. At this point in time this market remains a “buy on the dips” type of scenario, so you have to be looking at the Aussie as an estimate that you should be buying, not selling.