Today’s AUD/USD Signal

Risk 0.55%.

Yesterday’s pending order was not activated.

Best Buying Entries:

Long pending entry from the 0.7690 level.

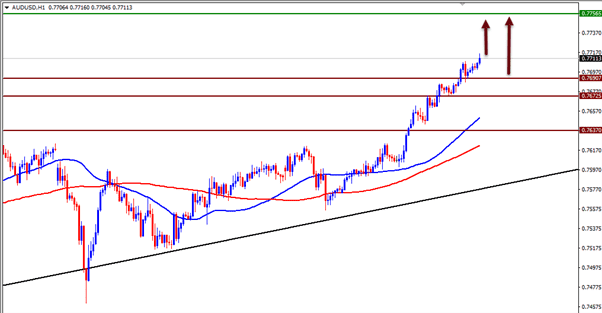

Put the stop loss below the 0.7672 support.

Move the stop loss to the entry point and continue profit with a 35 pips price movement.

Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7750.

Best Selling Entries:

Short entry below the 0.7640 level on the 4-hour timeframe.

Put the stop loss above the 0.7670 level.

Move the stop loss to the entry point and continue profit with a 25 pips price movement.

Close half the contracts when the trade is 35 pips in profit and leave the remainder of the contracts to run until the 0.7590 support.

AUD/USD Analysis

The AUD/USD pair rose yesterday to its highest level since April 2018 as increased investor risk appetite and USD sales helped boost the AUD. An increase in the price of gold, a commodity linked to the AUD, also boosted trust in the currency.

Disagreement in Congress regarding increasing the relief payment from $600 to $2000 contributed to the weakening of the USD against major currencies during the end of week and end of year trading.

The AUD/USD pair rose as expected yesterday, even if it didn’t activate yesterday’s long trade signal, and continued climbing to trade around 0.7711 above a strong support level at 0.7672, moving further away from the trend line and the 50 and 100 EMAs on the 4-hour chart.

Based on this, we can enter long positions from levels specified in the signal, according to the general bullish trend of the pair. Caution should be taken during trading this time of the year, as the Forex market in general sees a major drop in liquidity with a major drop in momentum as traders focus more on the holidays. Trading strategy and risk management should be adjusted accordingly.