Today’s AUD/USD Signal

Risk 0.75%.

The pair rose from the point of activation of yesterday’s buying recommendations, and the pair achieved the target mentioned in yesterday's recommendation.

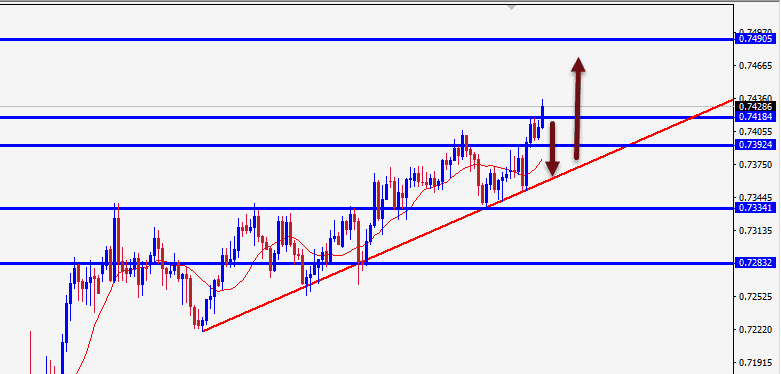

Best Selling Entries:

Short entry below the 0.7425 level on the hourly timeframe.

Put the stop loss above the 0.7470 level.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7290 support.

Best Buying Entries:

Long entry from the 0.7457 level on the hourly timeframe.

Put the stop loss below the 0.7425 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7519.

AUD/USD Analysis

The AUD/USD rose at the beginning of trading today, as traders followed up on the trade surplus data and other data on lending.

The Australian Bureau of Statistics reported that Australia posted a merchandise trade surplus of A$7.456 billion in October. Imports rose 1.0 percent month-on-month after a revised 6.5 percent decline in September.

In other data released this morning, the value of owner-occupied home loans issued in Australia rose by a seasonally adjusted 0.8 percent month-on-month in October to A$17.39 billion.

The AUD/USD is trading in a general upward trend, as the pair is trading at the 0.7418 level at the time of this writing. We expect the pair to record some correction, as the pair is currently trading at its highest levels in three months and at strong resistance levels.

We expect that the pair will witness some decline, as selling is more appropriate from the current price or from whenever the price approaches the support level mentioned above. If the pair continues to the upside and breaks all of them, then we can enter selling after retesting 0.7457.