Today’s AUD/USD Signal

Risk 0.55%.

The AUS/USD dropped yesterday with USD investors moving towards safe havens.

Best Buying Entries:

Long pending entry from the current price or the 0.7500 support level.

Put the stop loss below the 0.7488 support.

Move the stop loss to the entry point and continue profit with a 35 pips price movement.

Close half the contracts when the trade is 60 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7660.

Best Selling Entries:

Short entry below the 0.7470 level on the 4-hour timeframe.

Put the stop loss above the 0.7500 level.

Move the stop loss to the entry point and continue profit with a 25 pips price movement.

Close half of the contracts when the trade is 35 pips in profit and leave the remainder of the contracts to run until the 0.7400 support.

AUD/USD Analysis

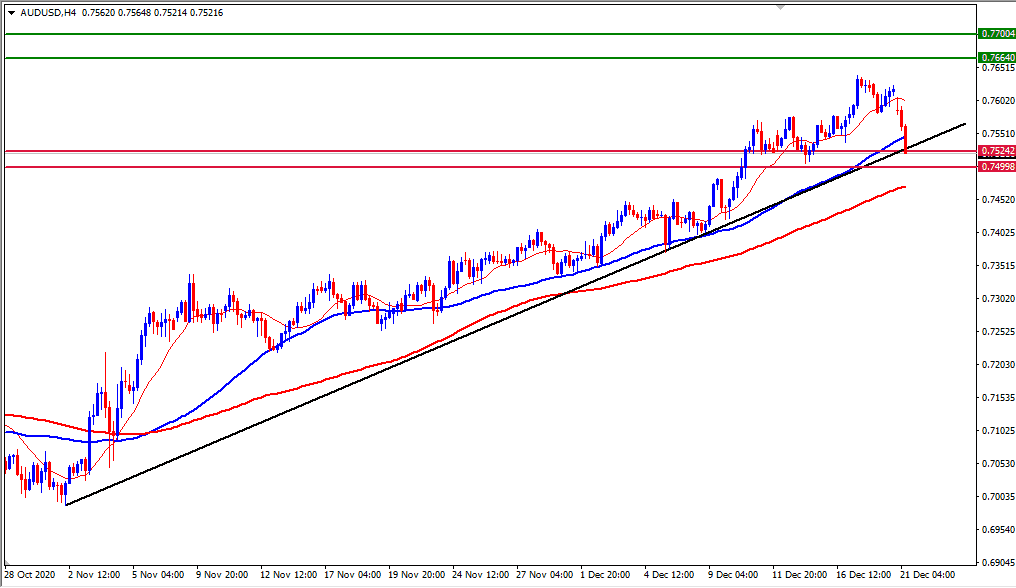

The AUD/USD dropped strongly with the opening of markets on Monday amid reports of a new strain of COVID-19 spreading in south London, which British Prime Minister Boris Johnson said is about 70% faster to transmit than the known strain of COVID-19. Reports of a travel ban to Britain raised investor concerns, prompting traders to buy the USD against riskier currencies such as the Australian dollar.

The AUD/USD pair is trading in a general bullish trend that is currently witnessing a strong correctional wave that represents a good buying opportunity. The pair is currently trading at the 0.75242 level, above the strong support level at 0.7500, and buying seems good from these levels if the pair stabilizes above the mentioned support.

On the other hand, the pair is trading at a bullish trend line after breaking the 50-day moving average on the four-hour time frame, while the 100-day moving average on the 240-minute time frame may represent the last strong resistance level. The correction waves that the pair may witness can be exploited into long positions. The best buying levels are on retesting the support level at 0.7500, where the pair targets 0.7660 level first, and then the 0.7700 level.

It is preferred that your trading strategy and risk management be adjusted accordingly.