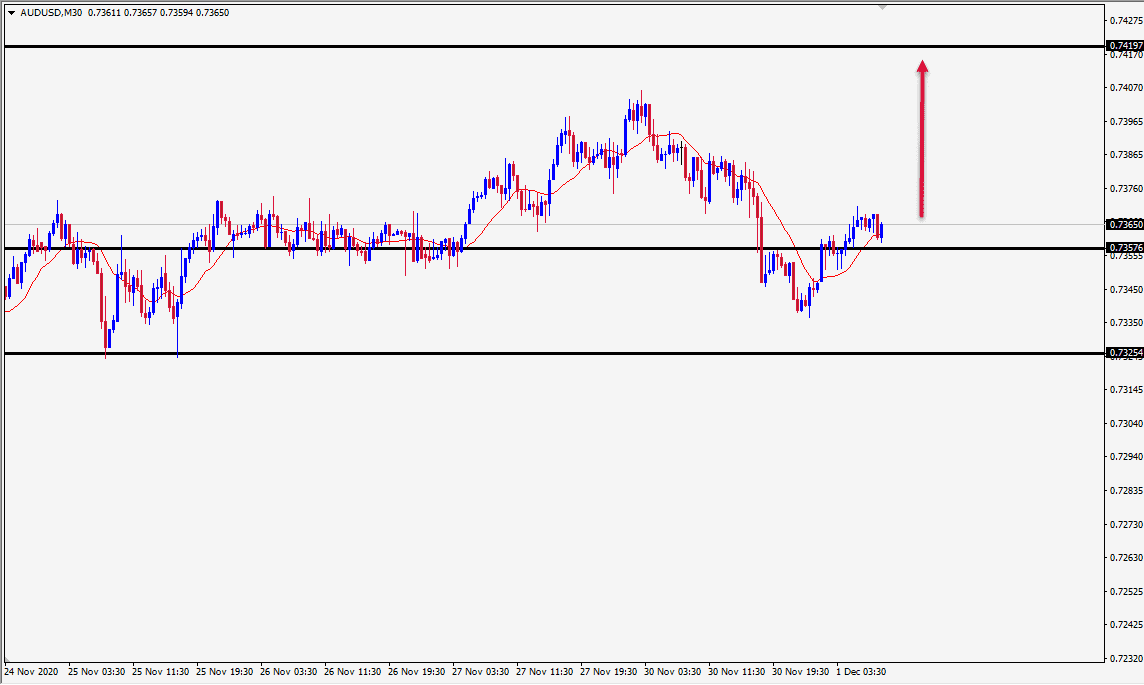

Today’s AUD/USD Signal

Risk 0.75%.

AUD reached the entry point and the goal has not been reached yet.

Best Buying Entries:

Long entry from current levels or better levels until the 0.7357 support on the hourly timeframe.

Put the stop loss below the 0.7325 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7419.

Best Selling Entries:

Short entry below the 0.7323 level on the hourly timeframe.

Put the stop loss above the 0.7335 level.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7276 support.

AUD/USD Analysis

The AUD/USD rose at the beginning of today's trading, with increased risk appetite after positive news about coronavirus vaccines. During Australian trading, traders followed the interest decision of the Australian Central Bank.

The Reserve Bank of Australia maintained the key rate and emphasized maintaining the low benchmark rate for at least three years.

The main interest rate was fixed at a record low of 0.10%.

The bank has kept the target set for the yield on 3-year Australian government bonds at around 0.1 percent.

The bank will keep the size of the bond purchase program under review.

On the technical front, the AUD/USD is trading in a general bullish trend in the medium term. The pair is trading at the time of writing at the 0.7366 level. We expect the pair to continue rising from the current levels as long as the price stabilizes above the strong support level at 0.7357.

Enter buying will be from the current price or from whenever the price approaches the support level mentioned above. If the pair reverses the trend and breaks all support lines, selling positions can be entered from a retest of 0.7320.