Today’s AUD/USD Signal

Risk 0.55%.

Yesterday’s signal was activated, and gain was chased but the target has not yet been achieved.

The buy signal should be cancelled in case the target was reached before the buy order is activated.

Best Buying Entries:

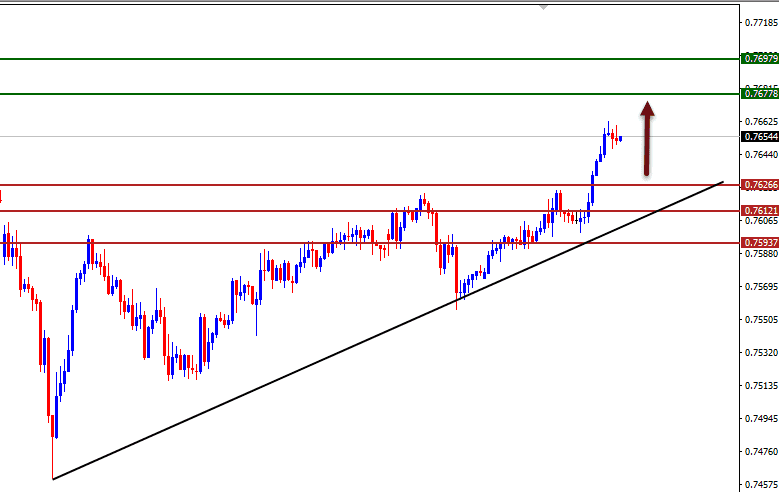

Long pending entry from the 0.7626 level.

Put the stop loss below the 0.7592 support.

Move the stop loss to the entry point and continue profit with a 35 pips price movement.

Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7700.

Best Selling Entries:

Short entry below the 0.7590 level on the 4-hour timeframe.

Put the stop loss above the 0.7620 level.

Move the stop loss to the entry point and continue profit with a 25 pips price movement.

Close half the contracts when the trade is 35 pips in profit and leave the remainder of the contracts to run until the 0.7520 support.

AUD/USD Analysis

The AUD/USD pair rose as the Australian dollar jumped against its US counterpart during morning trading. The move was strongly driven by the drop in the USD. The USD's decline continues despite efforts by Senate Majority Leader Mitch McConnell, who impeded Trump's and Democrats' efforts to increase direct stimulus payments from $600 to $2000. Treasury Secretary Steven Mnuchin said Americans will start receiving $600 checks today.

The AUD/USD advanced as we expected yesterday, as the pair activated yesterday’s buying signal to continue upward. The pair is currently trading at the 0.7651 level above strong support levels at 0.7626 and 0.7592 and above the trend line, in addition to the 50 and 100 moving averages on the four-hour time frame.

Based on this, it is possible to enter long positions from the levels specified in the signal, noting that the pair faces strong resistance levels that may succeed in the pair's fall to 0.7672 and 0.7713 levels, respectively, which are the targets of yesterday's signals.

Be careful during this period's trading, as the currency market in general has a significant decline in liquidity with a significant decline in momentum in light of traders' absence amid the holidays, so it is preferable to adjust your trading strategy and manage your risk accordingly.