Today’s AUD/USD Signal

Risk 0.55%.

The pair rose as expected in Thursday’s signal, though it did not achieve the target yet.

Best Buying Entries:

Long entry from the 0.7355 level on the hourly timeframe.

Put the stop loss below the 0.7315 support.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7472

Best Selling Entries:

Short entry below the 0.7305 level on the hourly timeframe.

Put the stop loss above the 0.7280 level.

Move the stop loss to the entry point and continue profit with a 20 pips price movement.

Close half of the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7250 support.

AUD/USD Analysis

The AUD/USD dropped at the beginning of this week's trading, despite positive data regarding the easing of closure restrictions on the largest affected states in the Australian continent. The State of Victoria decided to ease COVID-19 restrictions on Sunday after the hot spot of the epidemic in the country recorded 37 days without any new infections of the coronavirus, and is heading towards a "safe" holiday season.

In a press conference, Prime Minister Daniel Andrews said, "Today we can take some big steps, not as usual, but for a safe summer from COVID-19, we all have to remain vigilant and we all need to play our role."

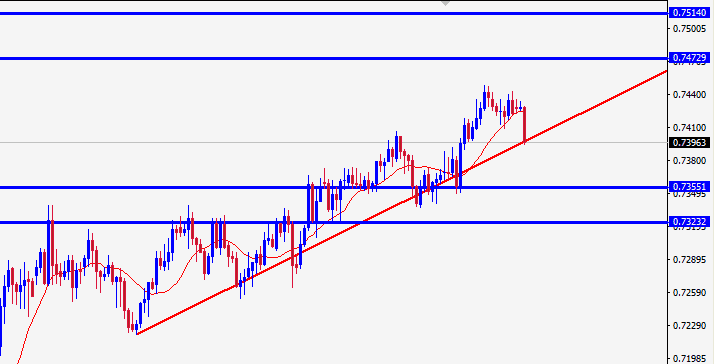

The AUD/USD pair is trading in a general bullish trend, but is witnessing a correction wave as the pair trades on a decline at the 0.7392 level at the time of writing, and is based on a rising trend line in addition to strong support levels.

We expect that the downside wave will not continue much longer and that the pair will rise again from the current levels or from the strong supports at 0.7355 and 0.73232, respectively, with targets reaching 0.7472 and 0.75140, respectively.