Today’s AUD/USD Signal

Risk 0.55%.

The pair rose as expected in yesterday’s signal before activating the point mentioned in the signal.

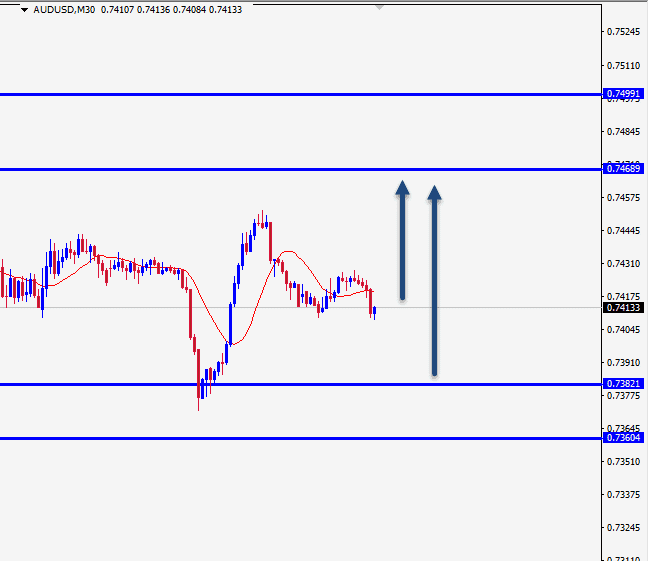

Best Buying Entries:

- Long entry from current levels or better levels until the 0.7382 or 0.7360 support levels on the 30 minutes timeframe.

- Put the stop loss below the 0.7300 support.

- Move the stop loss to the entry point and continue profit with a 20 pips price movement.

- Close half the contracts when the trade is 30 pips in profit and leave the remainder of the contracts to run until the strong resistance level at 0.7470

Best Selling Entries:

- Short entry below the 0.7298 level on the hourly timeframe.

- Put the stop loss above the 0.7310 level.

- Move the stop loss to the entry point and continue profit with a 20 pips price movement.

- Close half of the contracts when the trade is 40 pips in profit and leave the remainder of the contracts to run until the 0.7240 support.

AUD/USD Analysis

The AUD/USD rose during yesterday's trading, before recording some decline during the last US trades. The pair retreated with the beginning of today's trading amid positive data that showed expectations of a rapid economic recovery with easing restrictions and opening state borders, especially in Victoria, which is one of the most affected areas in the country. Australian business confidence improved over the past month, according to data released today from the Australian National Bank:

The Business Confidence Index rose to 12 from 3 a month ago.

The Business Conditions Index increased to 9 in November from 2 in October.

In other data, the Australian Bureau of Statistics announced that the Housing Price Index rose by 0.8 percent on a quarterly basis in the third quarter of 2020.

The AUD/USD pair is trading in a general bullish trend, as the pair is currently trading at the 0.7404 level above strong support levels concentrated at 0.7381 and 0.7360 on the half-hour time frame.

We expect that the downside wave will not continue much, so the pair will rise again from the current levels or from the strong support levels at 0.7382 and 0.73602, respectively, with targets reaching 0.7470 and 0.7500, respectively.