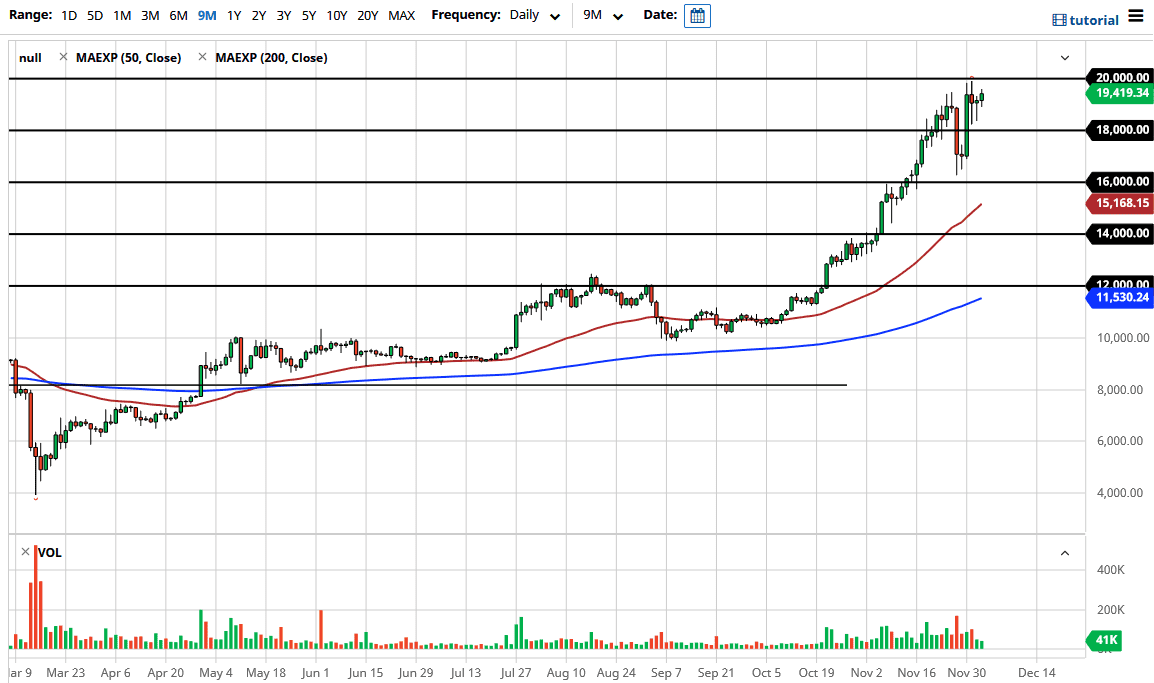

Bitcoin rallied slightly during the trading session on Thursday as we continue to sit just below the $20,000 level. By doing so, it looks as if the market is trying to convince itself to jump over that level, which of course has a certain amount of psychological importance built into it. Having said that, I do think that this is a market where participation is being gauged at this extraordinarily high level, and we may need to grind sideways for a while in order for people to get used to the idea of Bitcoin staying up in this particular region.

The Non-Farm Payroll numbers come out during the trading session on Friday and that could have a certain amount of influence on this market, at least in so much as to what happens with the US dollar. With that being the case, I think you need to pay attention to the US Dollar Index, which looks like it is trying to bounce just a bit, albeit from an oversold position more than anything else. If that does happen, you may get an opportunity to buy Bitcoin at a lower price, perhaps closer to the $18,000 level.

Even if that level does not hold I do believe that it is only a matter of time before we would find buyers underneath, perhaps at the $16,000 level. This is an area that has already seen a bit of support, and we are watching the 50 day EMA reach towards that level. Ultimately, I think that any dip will eventually see buyers due to the fact that we are in such an obvious uptrend.

Unlike the last time we were off at these high levels, it is not so much about you siege or hash rates, or anything else than the value of the US dollar. Ultimately, it is the one major fundamental thing that is working in the favor of crypto currencies, not just Bitcoin. Institutional money is starting to flow in as well so that of course will drive up the value eventually, and therefore I think we have a scenario where it is going to be difficult to short this market anytime soon. Even if we were to break out, it is probably easier to simply look for a buying opportunity, much like the S&P 500 tends to behave.