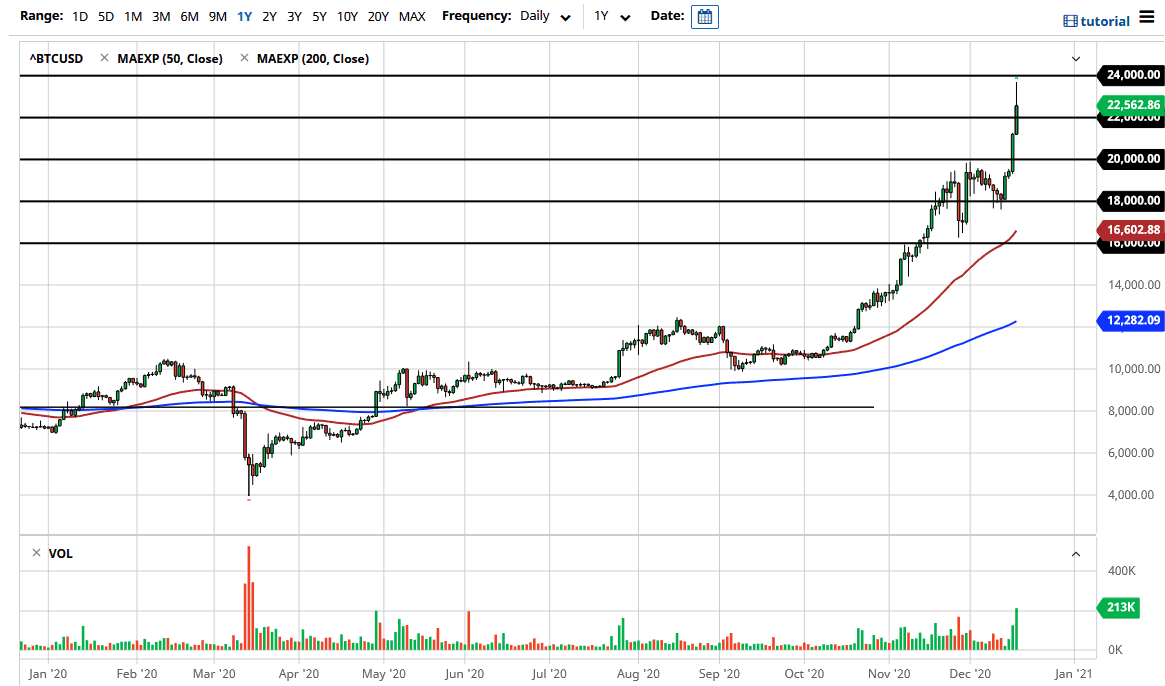

Bitcoin shot straight up in the air during the trading session on Thursday, as we continue to see the US dollar get hammered. In fact, at one point the market was testing the 24,000 level, an area that obviously would attract a lot of attention. We have officially broken the previous all-time highs a couple of days ago, and now the question is how much further can we go to the upside? There are people out there calling for $400,000 eventually, but that does not mean we get there tomorrow. In fact, I think we are well overdue for some type of correction again, perhaps down to the $20,000 level.

At the $20,000 level I would anticipate that there should be a lot of support, based upon “market memory”, and the fact that a lot of people who may have been shorting against that level will be more than willing to get out of the market at something close to breakeven. After all, it was a natural place to see shorting pressure due to the fact that it was roughly the all-time high. The question was not so much as to whether or not we can break through it in my opinion, it just had the makings of potential retail shorting.

We could even break down below the $20,000 level it would not change too much until we get below $16,000, which of course is quite a bit further to the downside. All things being equal, I think this is a market that will try to find some type of reason to go higher and therefore I think it is only a matter of time before we see buyers on these dips anyway. I do not like it when bitcoin, or any other market for that matter, spikes like this, because unfortunately a lot of people will go chasing the trade only to get absolutely smoked in the end. Keep in mind that no matter what you are trading, and this is especially true when it comes to Bitcoin, you need to find people above willing to think that the higher price is a “bargain.” While it could be in 10 years, it does not necessarily mean that it is right now. Think of those people who bought Bitcoin at $19,000 a few years ago. They are just now making a profit, assuming that they did not panic and sell out of it somewhere closer to the $5000 level or even lower. Granted, that is a much bigger expression of what is going on right now, but I do think that you could see a couple thousand dollars’ worth of selling without too much of a catalyst.