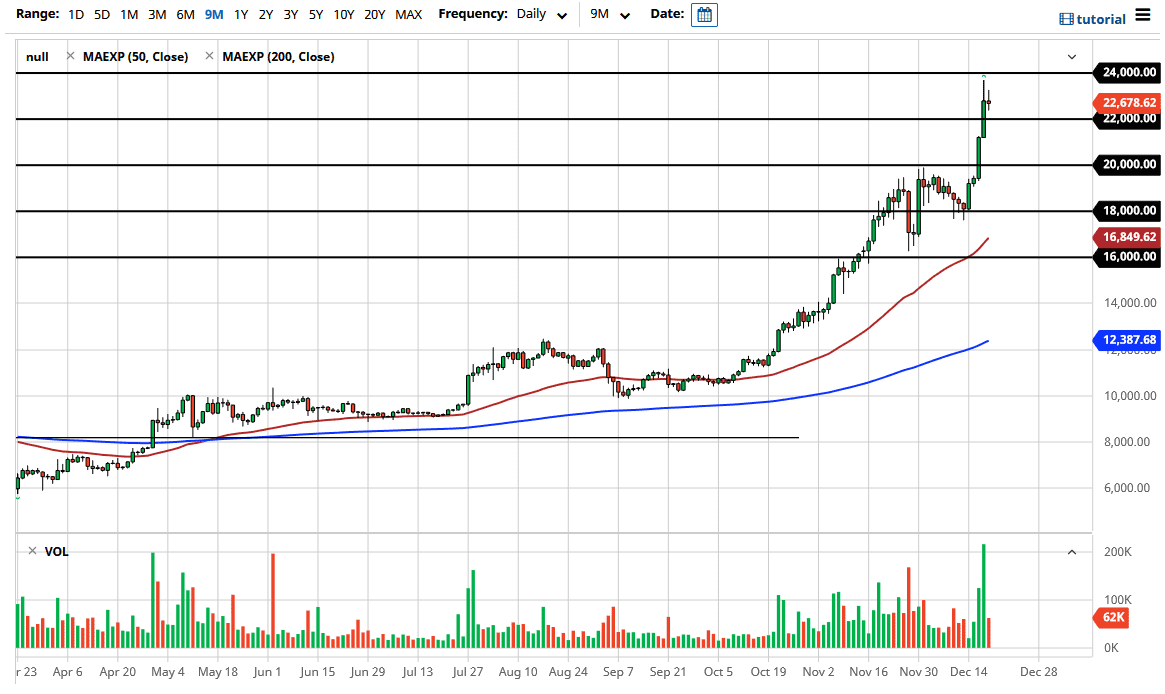

Bitcoin markets fluctuated during the trading session on Friday in what would have been rather quiet trading. Keep in mind that we are at extremely elevated levels, so this is not a huge surprise under the best of circumstances. Furthermore, we would have had serious problems with liquidity, so it is likely that you would see a lot of choppy behavior, and it is a perfect setup for a significant pullback. Underneath, the $20,000 level needs to be retested, as it was a major psychological barrier to overcome. As we head into the holidays, volume will probably drop, so it makes sense that we would sell off. After all, a lot of people will want to take profit heading into the next year, but I think that this would be a temporary “blip on the radar.”

To the upside, the $24,000 level will offer a significant amount of resistance, and if we can break above there, then it is likely that the market will really start to take off. However, we need to digest some of these gains and, although it has been a nice ride, markets cannot behave like this forever. The candlestick for the trading session on Friday could be a sign that we are ready to start falling again, but if you had gotten in the market at much lower levels, this pullback is something that you should be expecting. If you have not gotten involved at lower levels, then simply wait for a reaction to the $20,000 level and how that may cause the market to bounce and then continue going higher.

There are plenty of support levels underneath that you can look to as buying opportunities, and I have no interest in trying to short this market right now, because it is obviously in the midst of a major bull run. The institutional money is starting to flood into the Bitcoin market, so they will probably try to drive it as high as they possibly can. Bitcoin has already stated which direction it wants to go, so all you have to do is simply follow it.