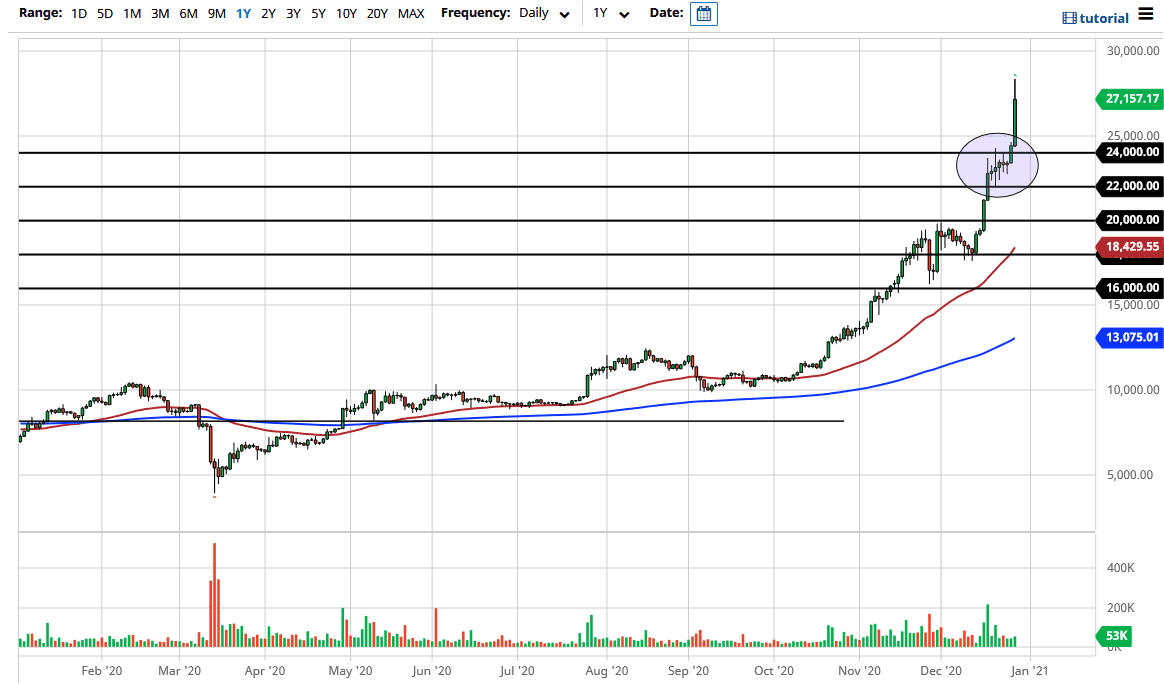

Bitcoin markets exploded to the upside again during the trading session on Monday, although in very thin trading. This does concern me a bit to be honest, even though I believe that this market in the long term will continue to go much higher. The market has made a huge push above the $28,000 level, but a simple glance at the chart can tell you that we are overbought by just about any metric you use. Yes, I recognize that some people can believe that Bitcoin is going to $1 million a unit, but you cannot get there overnight. The question now will become whether or not this was something real, or if it was simply due to a lack of volume.

Do not get me wrong, I do not believe that you can short Bitcoin anytime soon, but we are most certainly flirting with disaster at this point. I am a bit surprised that we chose to break above the $24,000 level right away without a pullback towards the $20,000 level. This is what I would be concerned about if I were buying Bitcoin at this time, because the $20,000 level almost certainly has to be retested at one point or another. The 50-day EMA is breaking above the $18,400 level, so it is likely that we could go looking towards the $20,000 level to test that 50-day EMA eventually. A market that is this parabolic is dangerous, to say the least.

All it is going to take is a bit of profit-taking by a large trader to cause a “knock on effect.” We have seen this before in the Bitcoin market, so it would not be a huge surprise. At this point, if you are not in this market right now and want to be, you need to wait for a pullback. At the very least, you would need to wait for the market pull back to the $24,000 level. Unfortunately, I fear that a lot of retail traders are simply jumping in with both feet and ignoring the massive amount of risk that could come into the market. If we see a sudden rush towards the US dollar, which is very possible at this point, that could also have a knock on effect over here as well. If you want to be buying this market, you need value.