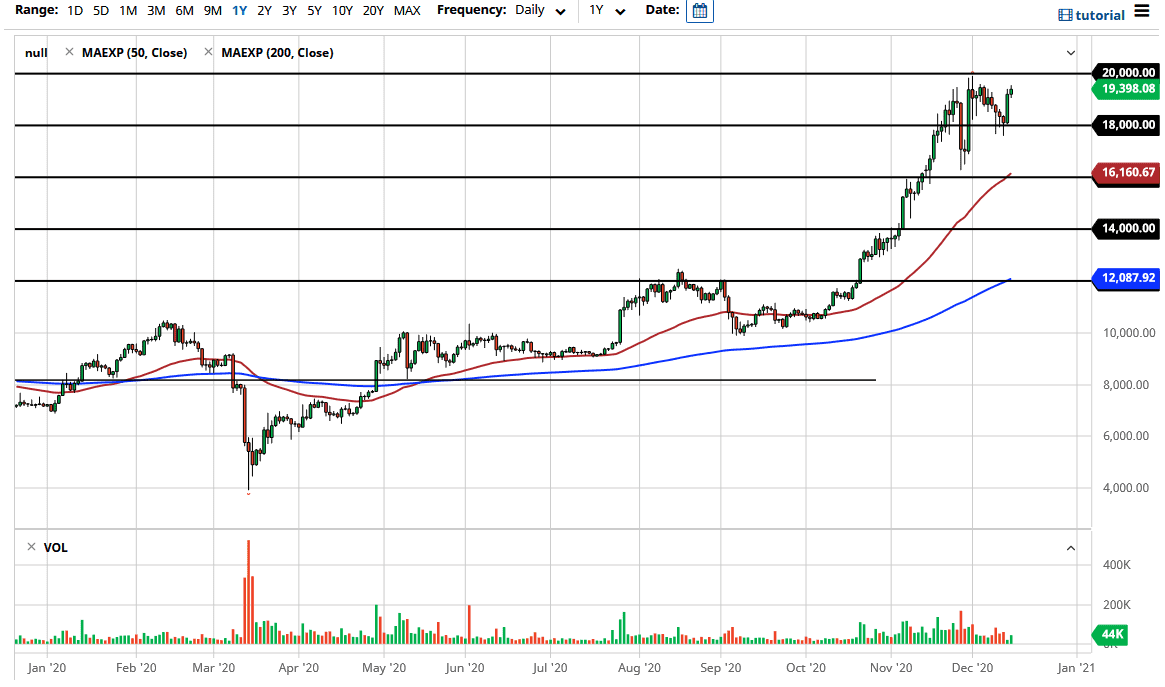

Bitcoin rallied again during the trading session on Tuesday as buyers continue to flood the market. As the Federal Reserve meets over the next two days and has an announcement on Wednesday, it does make sense that the US dollar is under scrutiny. After all, the Federal Reserve is likely to do something to bring down the value of the currency as the US economy appears to be slowing down. Further stimulus or asset purchases could send the greenback lower, so Bitcoin traders will be looking to protect their wealth by getting out of fiat again. It is likely that we will see the Bitcoin market make another attempt to break above the $20,000 level, but it should be acknowledged that $20,000 is a major level in this market.

To the downside, I see the $18,000 level as being massive support, which has been tested a couple of times over the last week or so. If we do break below there, then the market would go looking towards the 50-day EMA. The 50-day EMA currently sits at the $16,000 level, so it follows that we would see buyers there as well. Furthermore, we have seen that area tested and hold, so I suspect that we are looking at one of a couple of outcomes currently.

The most obvious outcome is that the market will break above the $20,000 level. If that happens, I fully anticipate that the Bitcoin market will take off to the upside and go looking towards the $22,000 rather quickly. After all, this market does tend to move in $2000 increments, so that simply would extrapolate out to what we quite often see in this pair.

The second possible outcome is that we will simply grind back and forth between the $20,000 level on the top and the $16,000 level on the bottom in order to consolidate and digest massive gains that this market has seen as of late. That would still be healthy and somewhat bullish, because it would allow the market to catch its breath after the massive shot higher. Furthermore, you need to build up a certain amount of confidence to finally break above the $20,000 level, which was where the market fell apart a couple of years ago.