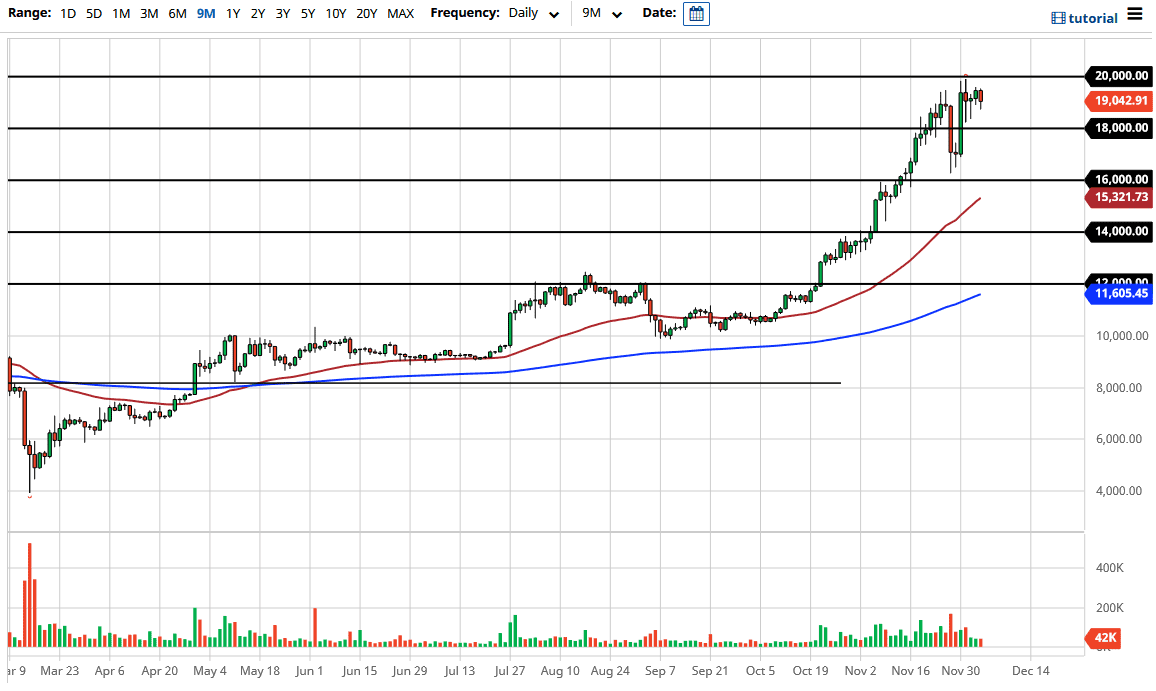

The Bitcoin market fell during the trading session on Friday, reaching down below the $19,000 level before bouncing slightly at the end of the day. The Bitcoin market continues to look very likely to see buyers jump into this market, in which case we will see plenty of pressure to finally break above the crucial $20,000 level. If we can break above there, the market is likely to have another leg out.

Keep in mind that the US dollar has been falling rather drastically over the last several weeks, which helps benefit the Bitcoin market as well as other crypto currencies. After all, most of them are priced in US dollars, at least the biggest markets. Overall, I think that the $20,000 level is offering a certain amount of psychological resistance, but the last couple of days probably have been more about getting used to the idea of pressuring the $20,000 level more than anything else. If the US dollar continues to fall, then we will see this market break out above the $20,000 level. If we do, then it will allow this market to go looking towards the $22,000 level, as it tends to move in $2000 increments.

In the short term, I believe that the area between $16,000 on the bottom and the $20,000 level on the top should continue to contain the market. I think we can bounce back and forth over the next couple of weeks and still feel relatively confident. Remember, Bitcoin does tend to move in drastic pullbacks occasionally, sometimes losing 20% in the blink of an eye. The last couple of candles have shown an attempt to break down, only to see buyers jump back in and pick it up. It certainly looks as if the US dollar is going to continue to struggle, so it is a way to get away from fiat currency, probably the one thing that both Forex and crypto currency traders seem to agree on as far as usefulness. I know there is a lot of noise about the usefulness of Bitcoin, but at this point it is more or less being traded a lot like gold in the sense that it is a way to get away from the greenback, euro, and other fiats.