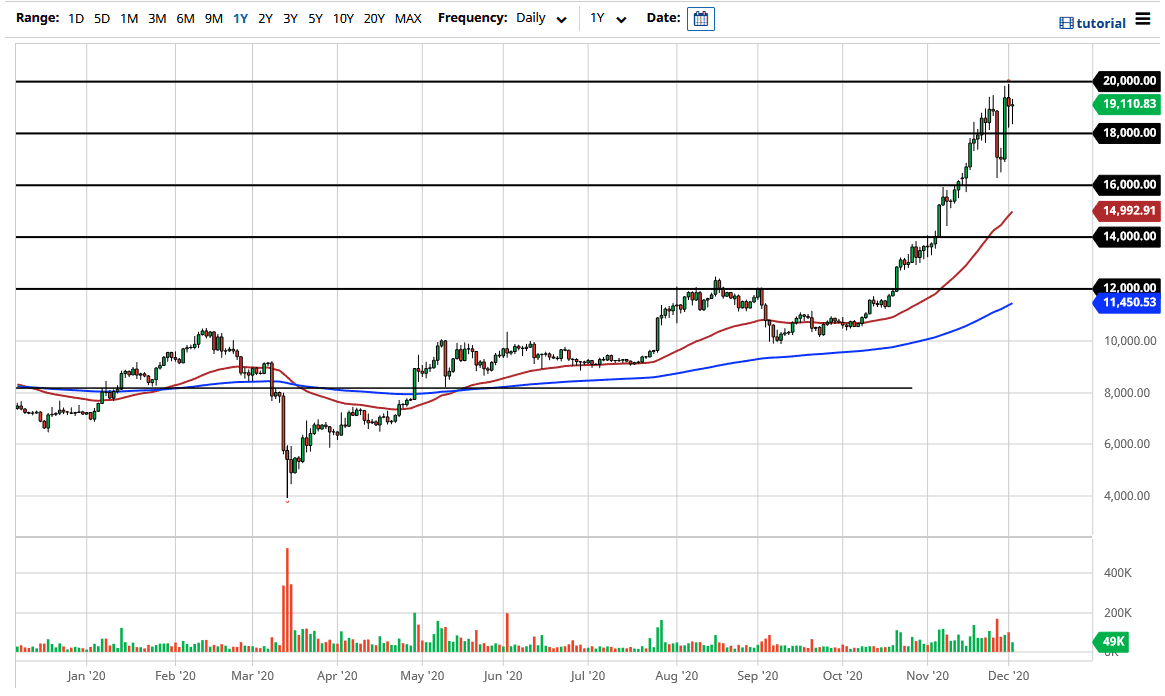

Bitcoin pulled back a bit during the trading session on Wednesday, only to find buyers yet again. In fact, it was almost a mirror image of the trading session on Thursday, as we continue to see the US dollar appreciate in value. Bitcoin has been used to get away from fiat currencies, and this is mainly an easy way to play the “anti-dollar trade.” It is not likely to continue forever, but clearly we are still very much in an uptrend.

One of the things that we need to pay attention to is the $20,000 level above, because we are essentially at all-time highs. If we can break above the $20,000 level, it would kick off the next leg higher, offering an opportunity for Bitcoin to go towards the $25,000 level. However, at the very least, we probably need to digest some of the gains and work off some of the froth in this market. Pullbacks should continue to see support at the $18,000 level and the $16,000 level. The 50-day EMA is starting to race towards that area, which is an area in which we have already seen buying pressure. The 50-day EMA is currently sitting just below the $15,000 level, which could attract attention as well.

However, if we break down below the 50-day EMA, it could unwind this market quite drastically. At that point, the market could go down towards the $12,000 level. However, we would need to see a significant turnaround in the US dollar or Bitcoin-related news to make that happen. Otherwise, we will simply continue to go to the upside, but the $20,000 level has been very difficult to break above. We see this with Bitcoin quite a bit, as it stalls at these big figures. Regardless, it is a market that you cannot be a seller of at this point, and if you do feel like you should be a seller, then perhaps looking for puts might be the best way as you can at least limit your downside.