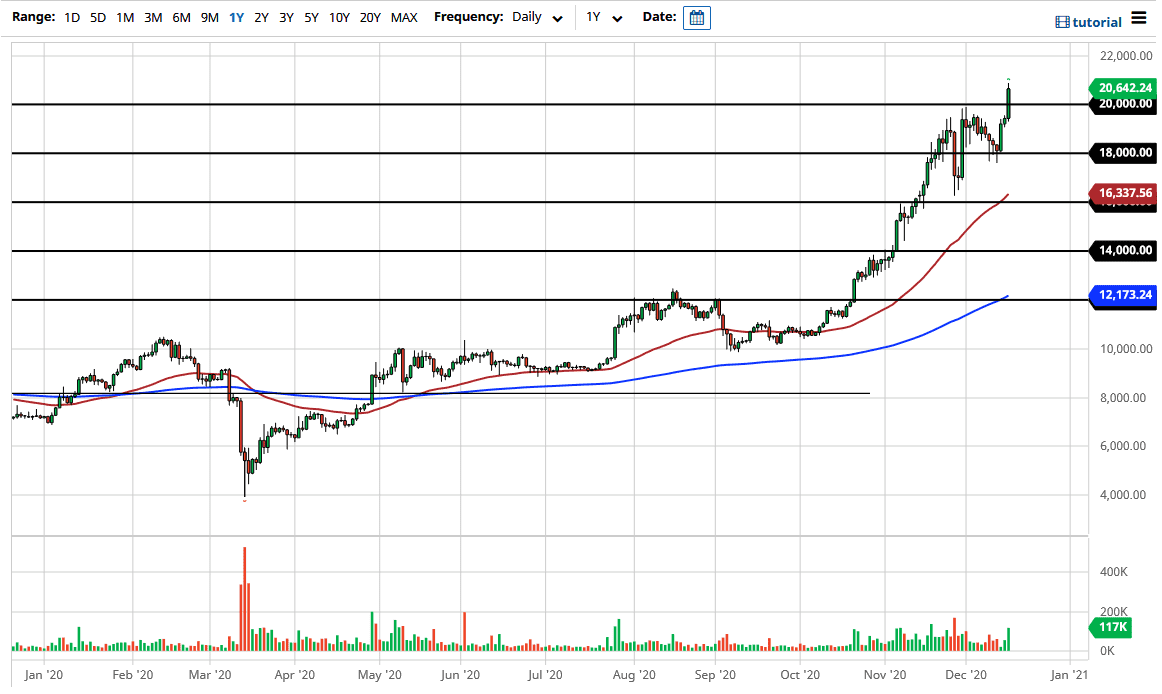

The Bitcoin market took off during the trading session on Wednesday, breaking above the $20,000 level quite handily. This is a major hurdle that has been overcome by the Bitcoin faithful, so it looks like we are ready to go much higher. If we do see a bit of a pullback, that only offers a nice buying opportunity that traders will use. The $18,000 level should be an area of importance, as it has offered support previously. However, now that we are well above the $20,000 level, it is unlikely that we will see an attempt to get down to that area.

The market is extraordinarily bullish of course, as the 50-day EMA is just now breaking above the $16,000 level. The $16,000 level would be what I would consider to be the “floor in the market”, which is a long way from here, so it is difficult to imagine a scenario in which we will get down to that layer. Short-term pullbacks will continue to offer buying opportunities, so there is little opportunity to short this market. Bitcoin continues to see a lot of “FOMO” coming into the marketplace. I have no interest in trying to short this market anytime soon, and even if you told me that it was going to break down during the trading session, I would not be interested in selling. The strength of the candle is that we are closing towards the top of the range, which is a very bullish sign.

In the long term, I anticipate that we will go to the $22,000 level because the market tends to move in $2000 increments. Bitcoin continues to attract a lot of attention and inflow, so it is hard to imagine that we would be interested in shorting. The markets should continue to go higher overall, so many traders will be looking at short-term pullbacks as value that people are willing to seize. Now that we are entering another leg higher, we could see an impulsive move rather soon.