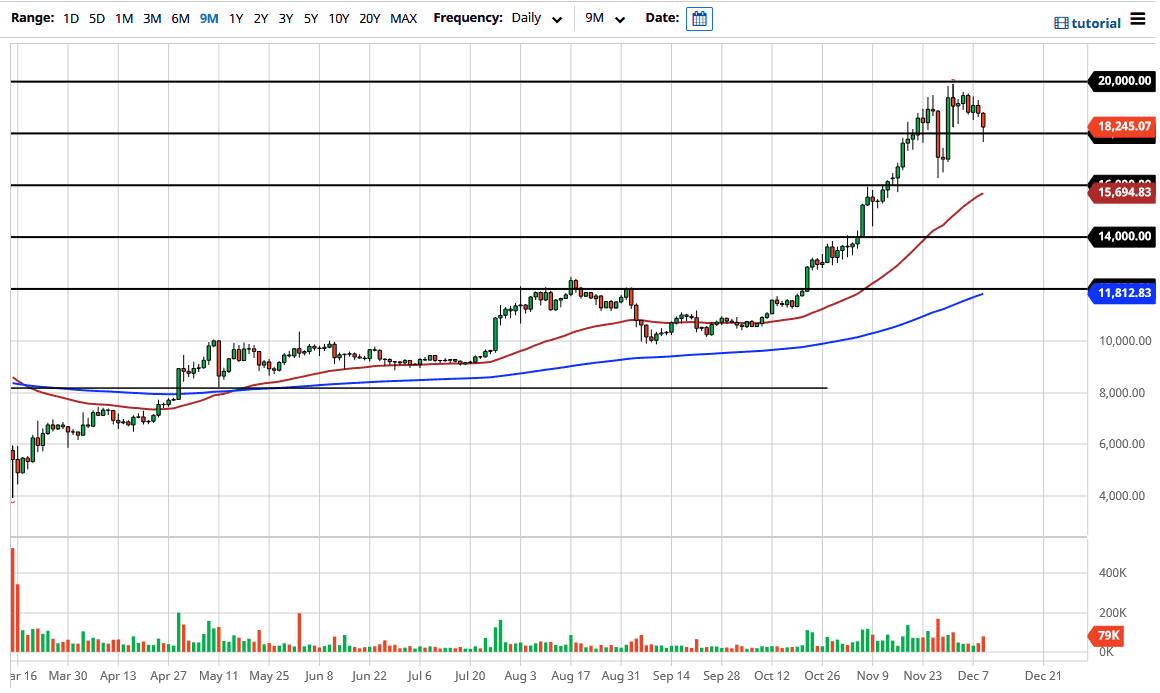

Bitcoin markets broke down during the trading session on Wednesday to break below the $18,000 level before finding support. However, this market is very much in an uptrend, so buyers will return and push higher. I think we need to go a bit lower though, but at the very least, we needed to pull back ever so slightly. After all, this is going to be about the US dollar, which got a boost during the trading session from an oversold condition.

The candlestick shape is a bit supportive, but we need to find a bigger pullback to truly find a significant amount of value we can use. We will eventually reach towards the highs again, as the market continues to see a lot of volatility in general when it comes to risk appetite. Remember, as the US dollar strengthens, it is quite often the case that Bitcoin moves in the opposite direction. I believe at this point we are simply trying to pull back in order to justify these elevated prices. We may see a bit more weakness, but I think it only offers buying opportunities.

Looking below, the $16,000 level or just above it would make sense, as the 50-day EMA is starting to reach towards that level. Furthermore, it has already proven itself to be somewhat supportive from the most recent pullback, so it all ties together quite nicely for a potential entry point. To the upside, we have the $20,000 level, which is obvious in its implications of resistance, as it is such a large, round, psychologically significant figure. Because of this, sellers will come back into the fray if we get near there, but a daily close above the $20,000 level would almost certainly open up the next leg higher, which a lot of people would be monitoring. I would be very cautious, but I also recognize that it is the goal for buyers at this point.