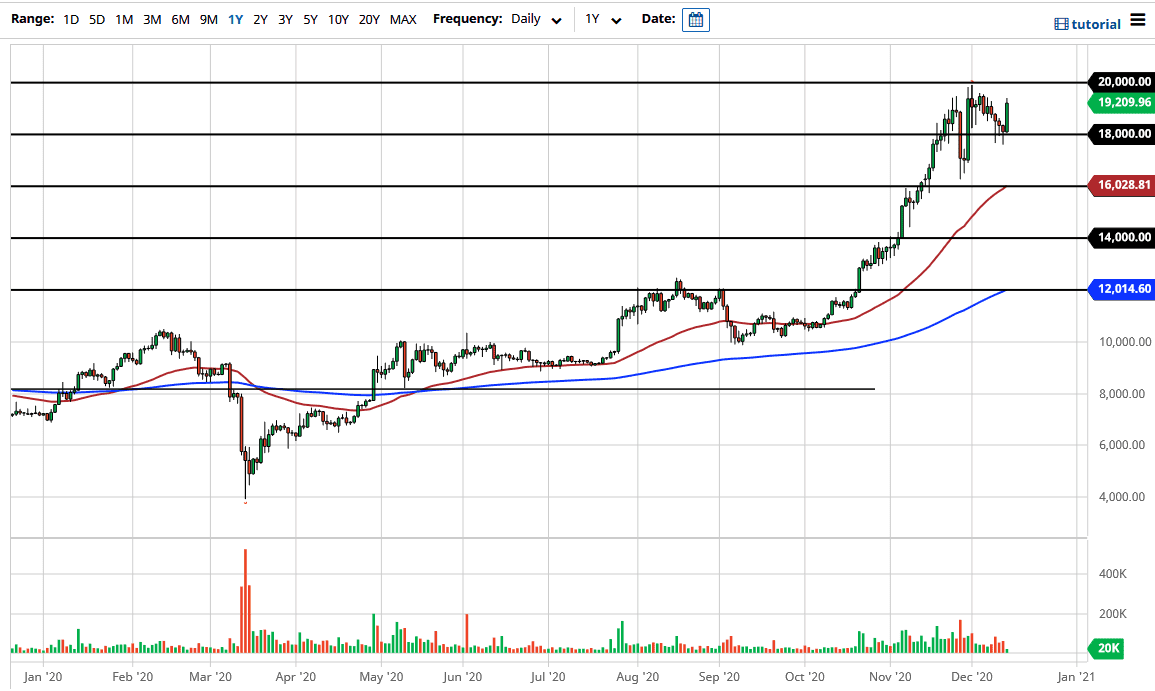

Bitcoin markets rallied significantly during the day's trading session, breaking the top of a hammer from the previous session, and using the $18,000 level as a springboard. The size of the candle is rather impressive, as we have gained $1200 during the session, and it looks as if we are going to try to go looking towards the $20,000 level again. This is an area that has obviously caused a bit of resistance, due to the fact that it is a large, round, psychologically significant figure and an area in which we have seen resistance previously. Furthermore, it is also an area from which we had broken down rather drastically several years ago.

The size of the candlestick does show more interest in the market, and I find this interesting considering that the US dollar was on its back foot initially during the day, but did bounce a bit later on while Bitcoin stayed where it was. However, every time we pull back there will be buyers looking to get involved in this market, especially now that the $18,000 level has shown itself to be so supportive. Breaking down below that level could open up the possibility of a move towards the $16,000 level, but I think that is less likely at this point. Furthermore, it is also interesting that the 50-day EMA is sitting right there, and that would cause a certain amount of support from a psychological, and perhaps even technical, standpoint. Keep in mind that the US dollar remains on its back foot, and should continue to lift the Bitcoin markets in general.

The $20,000 level being broken above and a daily close above that level would kick off the next leg higher. At that point, the market would likely go looking towards the $22,000 level, as the market does tend to move in $2000 increments over the longer term. I have no interest in shorting this market, because every time you think the Bitcoin market is going to fall apart, there are plenty of buyers to step in and pick it up. Given that, it is difficult to imagine a scenario in which sellers would overtake the market.