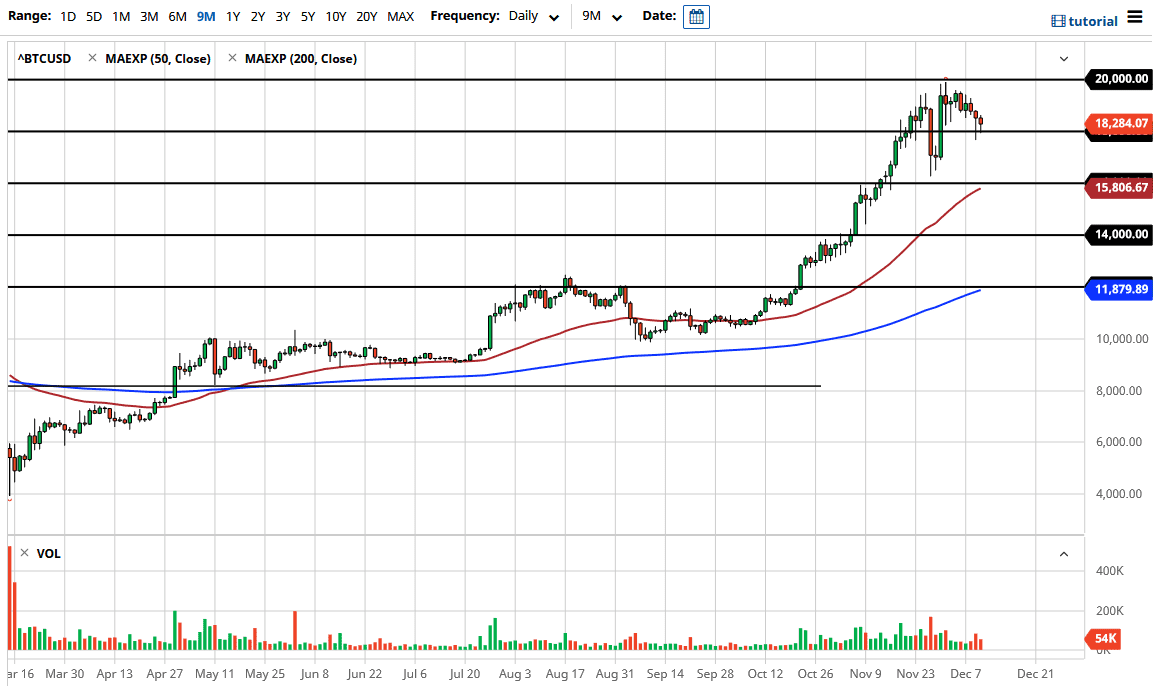

The Bitcoin market fell during the trading session on Thursday as we reached towards the $18,000 level. We have bounced from there slightly, but we are still likely to continue to see more selling, simply because the market has a lot of work to do in order to digest the massive gains that were previously seen. We had formed a hammer during the trading session on Wednesday, and the Thursday candlestick does seem to back that up. We probably will continue to go lower in the short term, but eventually we will see a turnaround.

What is interesting is that the US dollar had fallen during the day, but Bitcoin did not take advantage of it. I do not think this means anything other than that fact that Bitcoin might be overextended at the moment, which should be obvious for anybody who has been paying attention. I believe that a breakdown to the $16,000 level would be very healthy, but I recognize we may not even get that kind of selloff. The alternative scenario is to simply grind sideways between the $18,000 level and the $20,000 level in order for the market to get used to the idea of being up here. The real question now will be whether or not the market can break above the psychological barrier at $20,000. Remember, this is where the market fell apart a few years ago and completely crashed. I do not think that is about to happen now, but there is a certain amount of psychological resistance in this area. It would not surprise me at all if a lot of retail traders are simply cashing out at this point just to get back to breakeven.

What is needed next is going to be a fundamental reason to buy Bitcoin. This will probably be the US dollar declining further, but right now killing time is probably the most likely of scenarios going forward. Remember, Bitcoin does tend to move very wildly in short bursts, and then go sideways for what seems like forever. Because of this, none of this action that I see on the chart is particularly unique at this point.