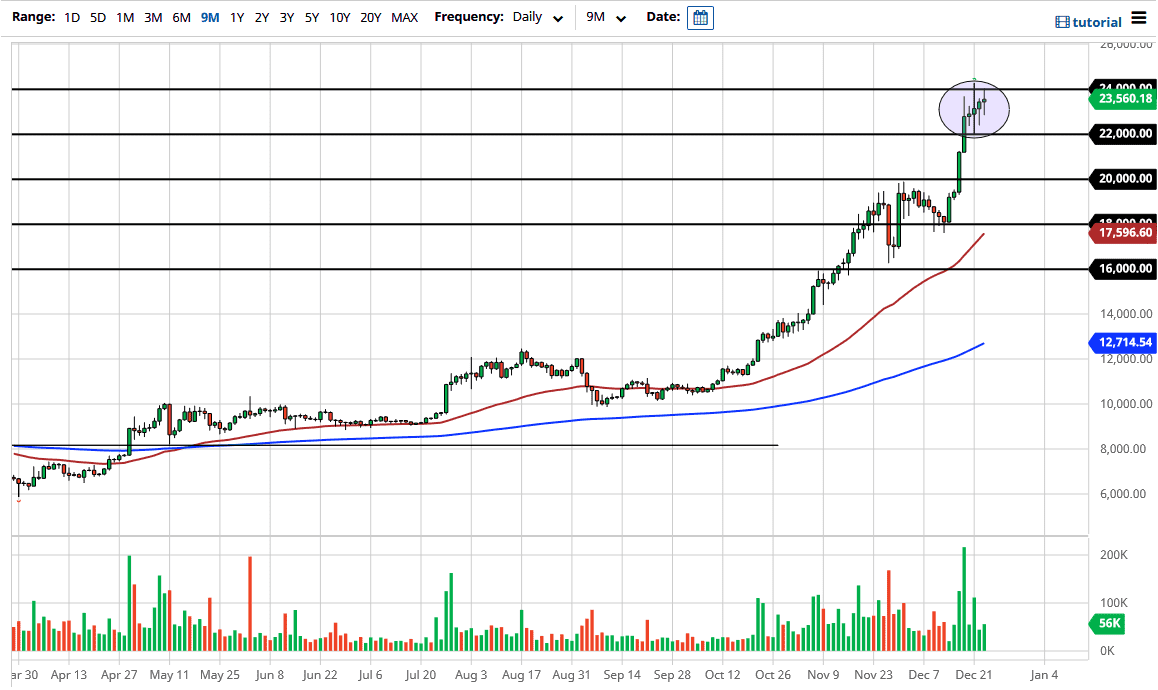

The Bitcoin markets fluctuated during the trading session on Wednesday as we continued to see the $24,000 level offer resistance. The market looks as if it is trying to go higher, but at the very least we need to kill some time. The last several days have seen the markets fluctuate more than anything else, perhaps trying to kill a bit of time after this massive shot higher up above the $22,000 level. Somewhere between the $22,000 and the $24,000 level we are trying to find some type of balance, but at this point I still think we are a little overdone.

The fact that we have formed four candles in a row that look a little on the unchanged side suggests to me that we are trying to build up momentum, meaning that most people were not willing to jump in and buy this market at this level. After all, you can see that just two weeks ago we were down at $18,000, so it is overbought to say the least.

A pullback is probably the healthiest thing that we can see right now, but I also recognize that we may simply have to go sideways. On a pullback, the $20,000 level underneath should be a massive support level, and there is a lot of interest down at that level. The 50-day EMA is reaching towards the 18,000 level, so it is very obvious to me that we are going to see plenty of buyers on some type of break down. However, we do not have the necessary catalyst quite yet, but Bitcoin tends to be in its own world at times.

On the other hand, if we do kill time here and then break above the $24,000 level, then it opens up the possibility for another leg higher. This is not necessarily out of the realm of possibility in this market, as we have seen more than once. There is no scenario right now that offers a selling opportunity for what I can see in this market. Because of this, simply being patient enough to pick up value is probably the best way going forward.