Bitcoin initially tried to rally during the trading session on Tuesday but continues to struggle with the idea of $20,000 above. This is interesting considering that the market has struggled at the same place it did a few years ago, right before the massive meltdown. Do not get me wrong, I am not calling for a massive meltdown - but what I am recognizing is that there is a certain amount of “market memory” at play right now. This market is moving based on the US dollar more than anything else. It should be noted that the US dollar rallied a bit during the trading session and is oversold in general. Because of this, we may see a bit of a pullback in Bitcoin, and I think that is welcomed.

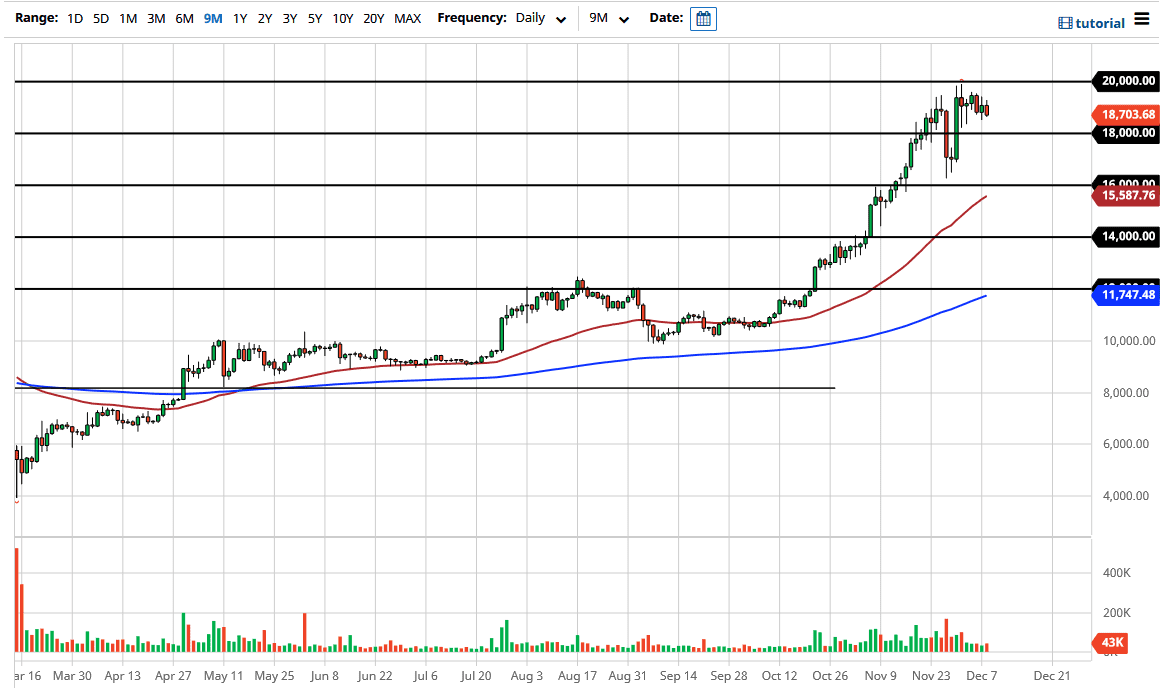

Looking at the chart, it is interesting that we tend to move in $2000 increments, and that is one of the main theories upon which I am building my trading plan. The $18,000 level will more than likely be tested, but I also expect that we could break down a bit lower than that. In fact, Bitcoin could find itself looking towards the $16,000 level, which should attract a certain amount of attention because it is not only the area from which we bounced previously, but it also features the 50-day EMA.

If we did break down below the 50-day EMA, it is possible that we will drop another $2000 to the $14,000 level. After that, we can talk about a move all the way down to the $12,000 level. I do not think we go that low, but if we did, I would anticipate a massive amount of support due to the fact that it was where the market broke out of to start this major leg higher. In such a case, many people would jump “all in” into the market, at which point I would anticipate that many long-term traders would be looking to invest even more. Even though the market would drop significantly to get down there, that is not a huge surprise in a market like Bitcoin. Alternatively, if we were to break above the $20,000 level on the daily chart, then we will continue to grind higher. The one thing that we do need is to kill time and digest the gains.