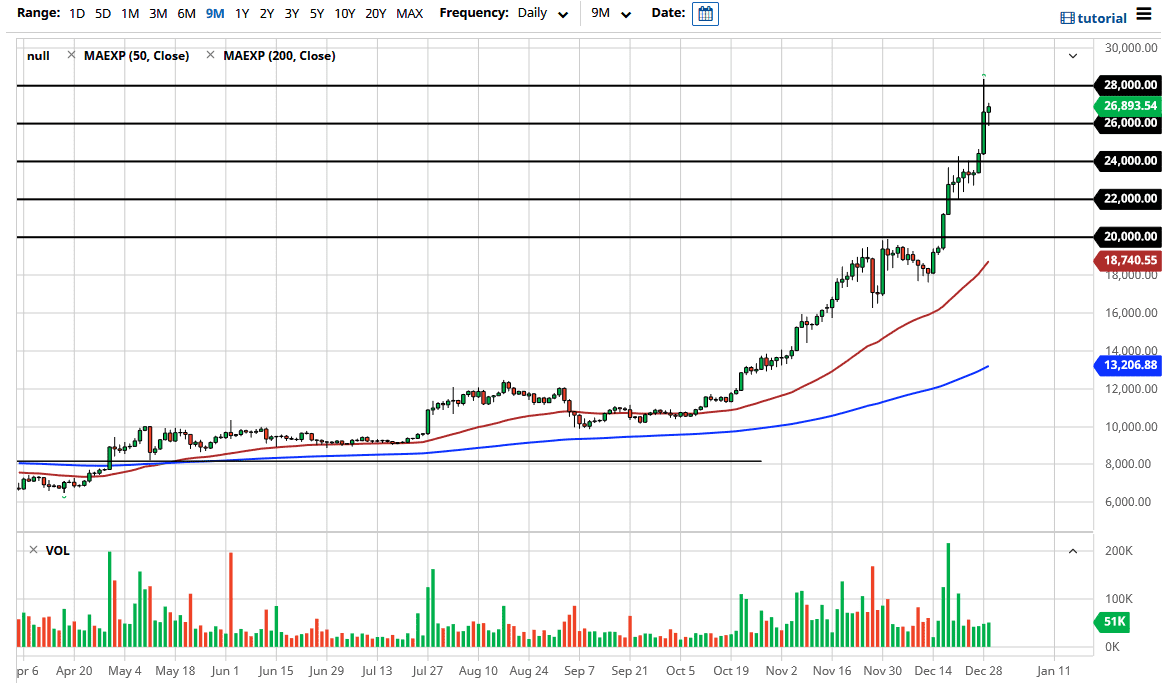

The Bitcoin markets fluctuated during the trading session on Tuesday in what continues to be an extended and stratospheric move. The market continues to see a lot of reasons for Bitcoin to continue going higher, mainly due to stimulus coming out the United States. This should bring down the value of the US dollar, and by extension, people will be looking to get away from the greenback and into some type of stored value. Recently, Bitcoin has been used for this, so it makes sense that we continue to see it grind higher. Furthermore, other central banks around the world continue to flood the markets with liquidity, driving down the value of other currencies. Because of this, Bitcoin continues to see a lot of strength.

The $26,000 level offered a bit of support during the trading session on Tuesday, and we did bounce from there. I am very concerned about just how out-of-control this move has been. The $28,000 level has been rather resistive, but it does look like we are trying to break above there. If we can break above there, then the market is likely to go looking towards the $30,000 level. The $30,000 level is certainly going to be a psychologically significant level that people will pay attention to, and it will garner some headlines. I believe that it is only a matter of time before we see some selling pressure come back into this market, because it is overdone.

This is not to say that we are likely to be able to sell Bitcoin, because it is in an astronomically strong move and these things can cause heartache for those who try to jump in front of a moving train like this. To the downside, the $20,000 level should be supportive, and perhaps where a lot of buyers would jump in. It would not be overly surprising to see Bitcoin take a dive like that again, because it has done so historically more than once. Every time we pull back, it is likely that there will be plenty of people trying to jump on board. As long as there continues to be stimulus, Bitcoin will probably continue to be used as safety.