While Germany posted better-than-expected industrial production for October, it was before Chancellor Angela Merkel imposed a second nationwide lockdown. High-frequency indicators suggest a slowdown since November, and Europe’s largest economy faces increased recession risks. The DAX 30 remains exposed to a healthy profit-taking sell-off with a pending breakdown below its resistance zone.

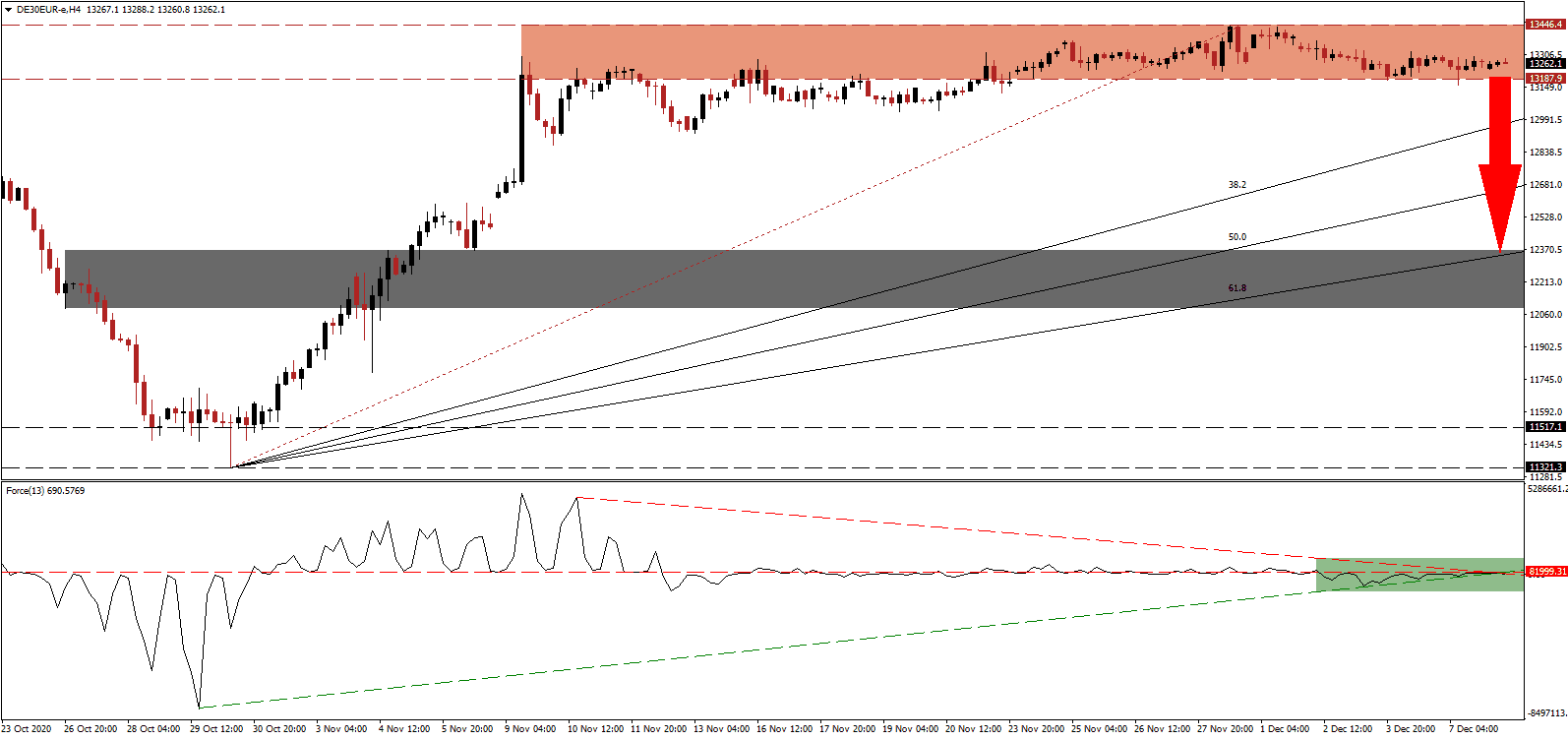

The Force Index, a next-generation technical indicator, confirms the lack of bullish pressures to keep the advance alive and settled below its horizontal resistance level, as marked by the green rectangle. Following the convergence of the descending resistance level and the ascending support level, breakdown pressures magnified. Bears wait for this technical indicator to move below the 0 center-line to regain complete control over the DAX 30.

Amid the COVID-19 crisis, the Green Party believes it can convince voters to boost debt and alter the economy. Recent polls confirm it is presently the second most-favored party, granting the Greens unprecedented leverage in German politics. The party detailed a €500 billion spending program. Bearish pressures in the DAX 30 can result in a breakdown below its resistance zone between 13,187.9 and 13,446, as marked by the red rectangle.

Chancellor Merkel warned that COVID-19 aid cannot last indefinitely and that Germany must start repayment by 2023. She added stimulus was possible only due to budget surpluses in preceding years, hinting at a return to austerity. Merkel also warned that hope alone does not suffice. The DAX 30 can correct into its short-term support zone between 12,087.6 and 12,366.8, as identified by the grey rectangle. The ascending 61.8 Fibonacci Retracement Fan Support Level is on the verge of eclipsing it.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 13,260.0

Take Profit @ 12,370.0

Stop Loss @ 13,500.0

Downside Potential: 8,900 points

Upside Risk: 2,400 points

Risk/Reward Ratio: 3.71

In case the Force Index moves above its ascending support level, acting as resistance, the DAX 30 may attempt a breakout. The upside potential remains reduced to its resistance zone between 13,735.7 and 13,827.9, which will offer traders a secondary selling opportunity. With global trade depressed, the outlook for equities maintains a bearish bias.

DAX 30 Technical Trading Set-Up - Reduced Breakout Scenario

Long Entry @ 13,650.0

Take Profit @ 13,820.0

Stop Loss @ 13,500.0

Upside Potential: 1,700 points

Downside Risk: 1,500 points

Risk/Reward Ratio: 1.13