Germany continues to report over 20,000 new COVID-19 infections daily, but the ZEW economic sentiment indicator for December surged amid misplaced hopes that a vaccine will lead to a swift recovery. Employment remains weak, and the outlook uncertain. The DAX 30 remains vulnerable to a breakdown below its resistance zone, which can result in a more massive correction.

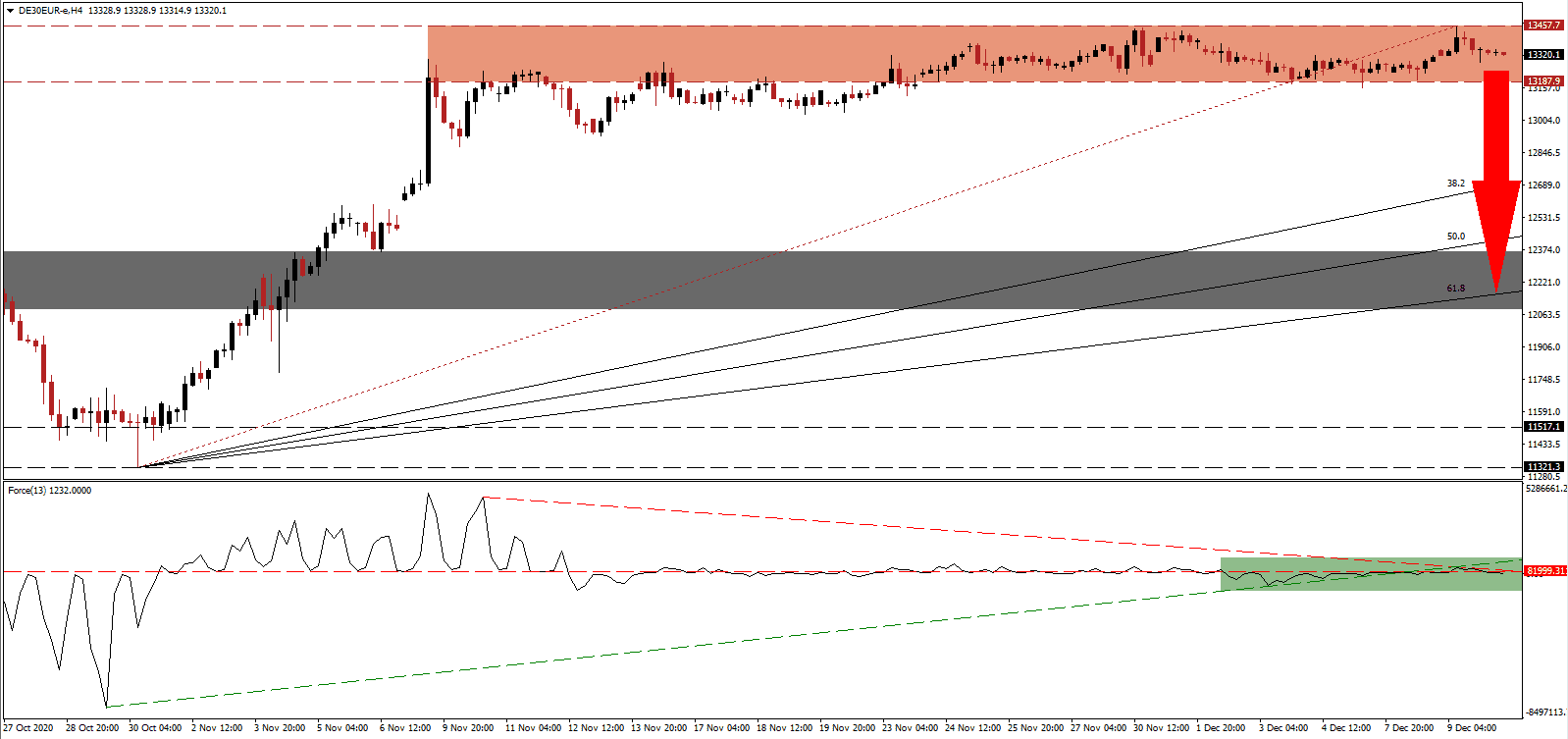

The Force Index, a next-generation technical indicator, remains below its ascending support level and its horizontal resistance level, as marked by the green rectangle. Adding to bearish pressures is the descending resistance level. Bears wait for this technical indicator to slide below the 0 center-line and accelerate to the downside to regain complete control over the DAX 30.

October exports for Germany rose less than forecasted, and imports confirmed domestic weakness. Europe’s largest economy remains at risk of a double-dip recession, and Chancellor Merkel warned that financial support would not be indefinite. Bearish pressures in the DAX 30 remains dominant, favored sparking a profit-taking sell-off following a breakdown below its resistance zone between 13,187.9 and 14,457.7, as identified by the red rectangle.

Confirming ongoing economic issues across the European Union is the European Central Bank, expected to announce €500 billion in new stimulus as soon as today. It will further subtract from the future output and add to long-term issues. The DAX 30 is well-positioned to correct into its short-term support zone between 12,087.6 and 12,366.8, as marked by the grey rectangle, enforced by its ascending 61.8 Fibonacci Retracement Fan Support Level.

DAX 30 Technical Trading Set-Up - Profit-Taking Scenario

Short Entry @ 13,320.0

Take Profit @ 12,220.0

Stop Loss @ 13,500.0

Downside Potential: 10,000 points

Upside Risk: 1,800 points

Risk/Reward Ratio: 5.56

Should the Force Index reclaim its ascending support level, acting as resistance, the DAX 30 could attempt another breakout. With the short-term outlook worsening, traders should consider any advance as a selling opportunity. The upside potential remains limited to its resistance zone between 13,735.7 and 13,827.9

DAX 30 Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 13,650.0

Take Profit @ 13,820.0

Stop Loss @ 13,500.0

Upside Potential: 1,700 points

Downside Risk: 1,500 points

Risk/Reward Ratio: 1.13