The DAX Index initially drifted lower during the trading session on Thursday but found enough buying pressure to turn things around and reach towards the 13,584 level by the time we closed. What is worth noting is that the Brexit deal was signed, so there would have been a bit of a boost as it should continue to facilitate trade between the continent and the United Kingdom. This can only be good for Germany, which relies so much on exports.

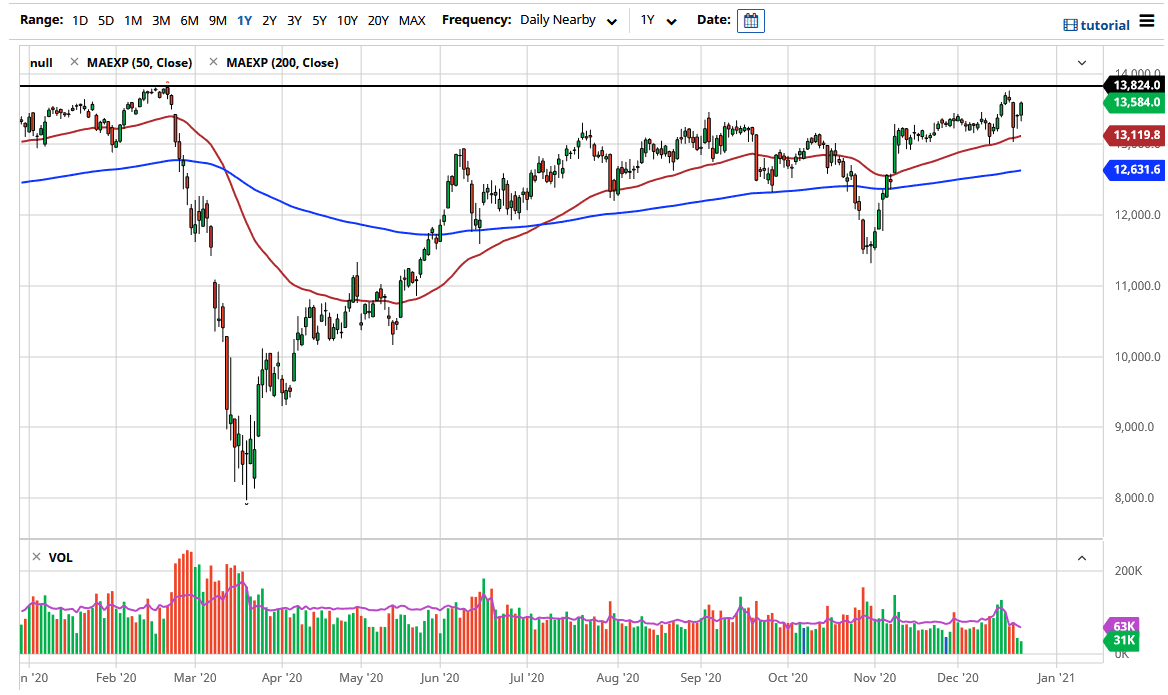

The most obvious thing to notice on the chart is that we have been in an uptrend for some time, which is something that should be closely watched. We had bounced from the 50-day EMA underneath, and that is a sign of dynamic strength. This is a market that looks as if it will try to go towards the highs at the 13,825 level. We have seen buyers on dips, and I think that should continue to be the case.

There are a couple of different things to be worried about when it comes to German stocks currently, though. The first thing is that the euro could continue to strengthen. If it does, that tends to work against the value of the DAX due to the idea of cheap German exports which is a huge part of the index. The other thing that could be an issue is that the coronavirus has continued to lock down economies around the world, so it is possible that we will see economies suffer, including Germany. It does look like most people are looking forward to the “post-coronavirus world.” If that is the case, then German exports should pick up, as growth has been extremely depressed for some time. If we can break out to a fresh, new high at the 13,824 level, then the market could continue to go much higher. The 14,000 level after that would be the initial target, and then eventually the 15,000 level further down the road. I have no interest in shorting the DAX, as it is obviously very strong.