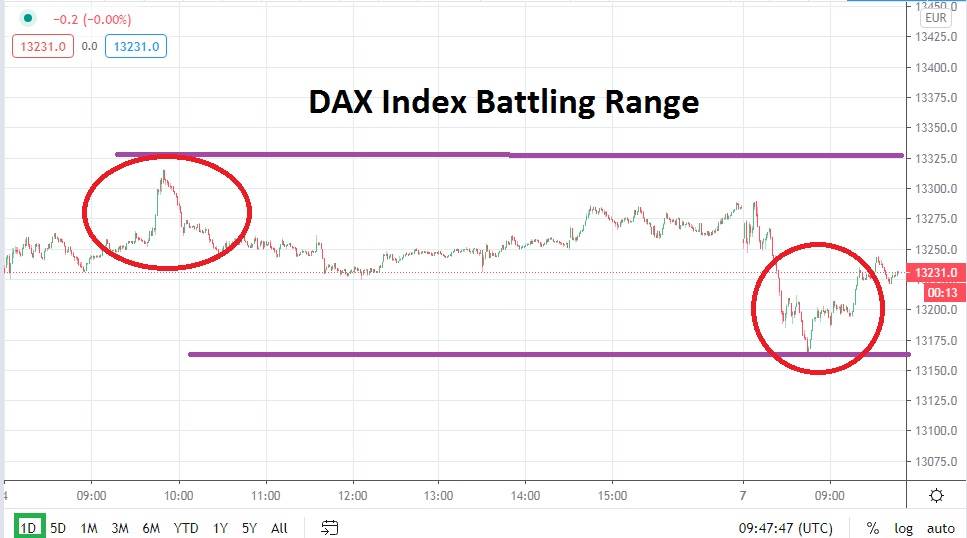

The DAX Index has been within a pitched battle to attain higher values the past week and has failed to attain new highs. However, the above is not written with a gloomy perspective, because encouragingly, the DAX Index has not seen a robust amount of profit-taking either. This could mean the current price range of the German index is serving as a vital accumulation point and may be capable of producing additional upside momentum.

Mid-term tests of higher values by the DAX Index has seen equity prices take a hit as the index has turned in rather violent bearish trends. However, this recent run up in values for the DAX Index has not produced violent sell offs. Support levels have been tested but they have actually proved fairly adequate and not stoked fear into investors. Evidence for this point lurks in the rather polite reversals lower which have transpired the past week and lack of spikes which often plague the DAX Index.

Risk appetite in the major equity indices remains stable to optimistic. Before heading into the weekend, the US stock markets turned in another positive session. Although futures markets via the US indices do indicate a negative opening today as the week of trading begins, this comes on the heels of a rather stellar short-term performance which has seen the Dow Jones Industrials challenge record highs.

The short term may remain challenging for DAX Index speculators, but the ability to remain positive and within a buying mode may be the best wager. Timing the rise of equity markets is not easy, but speculating on a bullish outlook cannot be faulted, because global risk appetite remains rather optimistic. The next two weeks of trading within equity markets will be of keen interest as the holiday season approaches. Optimistic traders may suspect a bullish holiday market is about to emerge based on a lack of strong reversals lower.

Buying the DAX Index on pullbacks towards support levels may be a solid speculative wager for traders who believe the German index technically has the ability to produce another leg upwards. If the DAX Index can sustain its value within its current price range between 13210.000 and 13260.000, it could set the stage for fruther bullish momentum to develop sooner rather than later.

DAX Index Short-Term Outlook:

- Current Resistance: 13285.000

- Current Support: 13193.000

- High Target: 13352.000

- Low Target: 13150.000