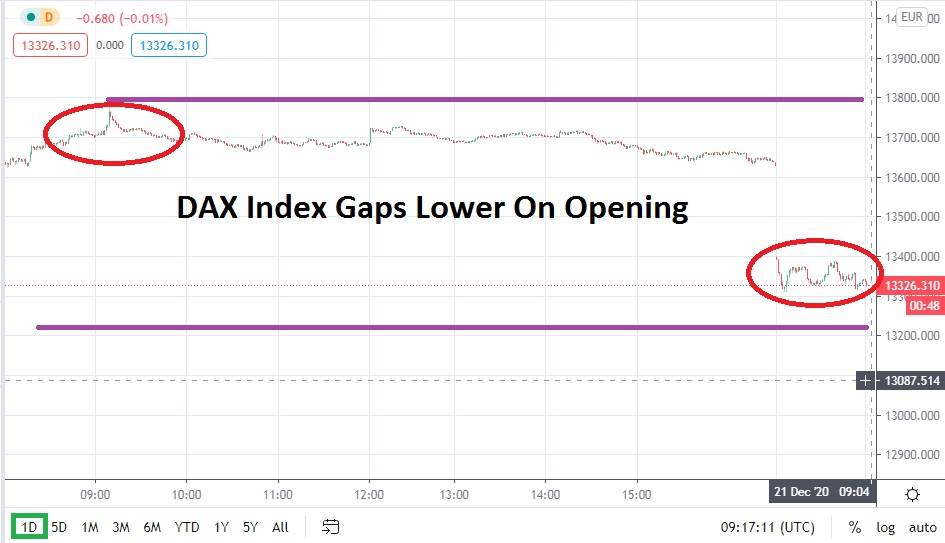

The DAX Index has been propelled lower with a strong gap in early trading today on rising concerns regarding news of a mutated coronavirus strain in the UK. Germany and France have been quick to initiate travel restrictions with the UK as fears mount regarding the implications about the newfound mutation. The DAX Index was trading near the 13770.00 level on Friday, but as of this writing, the index is traversing near the 13320.00 juncture.

Speculators should be careful to examine technical charts and pay attention to short-term news developments. Traders also need to understand that the possibility exists that some investors may have used the coronavirus reports as an excuse to cash in profits that have been made recently. The DAX Index should be watched to see if it can maintain its current values and prove that support levels near 13300.00 can be durable.

If the current value of the DAX Index is sustained and doesn’t suffer from further spikes downward, there is reason to suspect that a reversal higher could develop. Technical traders will certainly have their perceptions tested as the holiday trading season fully develops this week. However, if support levels do prove capable of holding their value, today’s gap lower may be digested and become an opportunity to take advantage of a short-lived selling gyration which will run out of steam as risk appetite endures.

The coronavirus news certainly has implications short term on sentiment for traders, but global risk appetite has been able to demonstrate an ability to fight through short-term fears. Additionally, speculators should pay attention to reports from the US which suggest that there is a potential for a newly initiated stimulus package to be approved by Congress sooner rather than later. If the US stimulus package is signed, it could spur on additional risk appetite in the markets which could have a positive effect on the DAX Index.

The support junctures between 13300.00 and 13270.00 are important; if trading is sustained above these levels, it may indicate that investors have accepted the latest bout of bad coronavirus news and are willing to become buyers again. Buying the DAX Index with limit orders near current support levels may feel speculative as dark shadows loom, but traders may be willing to wager that positive sentiment will prevail again.

DAX Index Short-Term Outlook:

- Current Resistance: 13415.000

- Current Support: 13270.000

- High Target: 13493.000

- Low Target: 13190.000