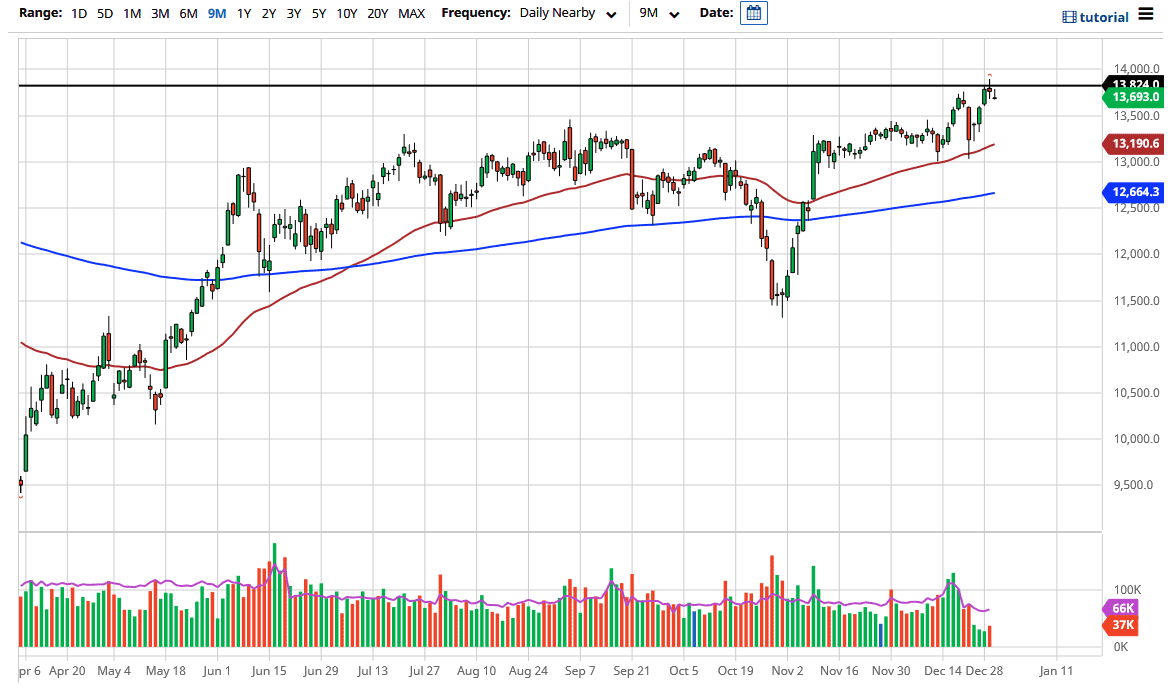

The DAX gapped lower during the trading session on Wednesday only to turn around and fill the gap. We have fallen from there and it is worth noting that the €13,825 level had previously caused resistance several months ago, and now we are seeing that area offer resistance yet again. The question is whether or not we can break above this level on a daily close. At this point, it is a bit difficult to see that happening in the short term, perhaps due to the fact that the euro has been so strong against the US dollar.

Underneath, the €13,500 level is an area that could cause some support due to the fact that it was previous resistance. After that, the 50-day EMA sits at €13,190, which is an area that also has offered support in the past. I think it is only a matter of time before the DAX finds buyers underneath, as it is a leading indicator of stocks in the European Union. When you look to play the European stock markets, the DAX is essentially where it is thought of as “blue-chip stocks.” The market is likely to continue to see a lot of fluctuation as we head into the new year, but with stimulus coming out of several central banks around the world, the idea is that Germany will continue to be able to export.

The euro rising too quickly will be very negative for the German index, due to the fact that people will be worried about whether or not exports will suffer at the hands of being too expensive in various other places. The DAX is full of export-driven companies, but with all the stimulus around the world it is likely that stocks will continue to find a bid. If we do break out above the resistance level, then I think we will go looking towards 14,000, and then eventually 15,000, as it is the next large figure and stocks seem to be trying to form a massive “V pattern”, and it could send this market into the next leg higher.