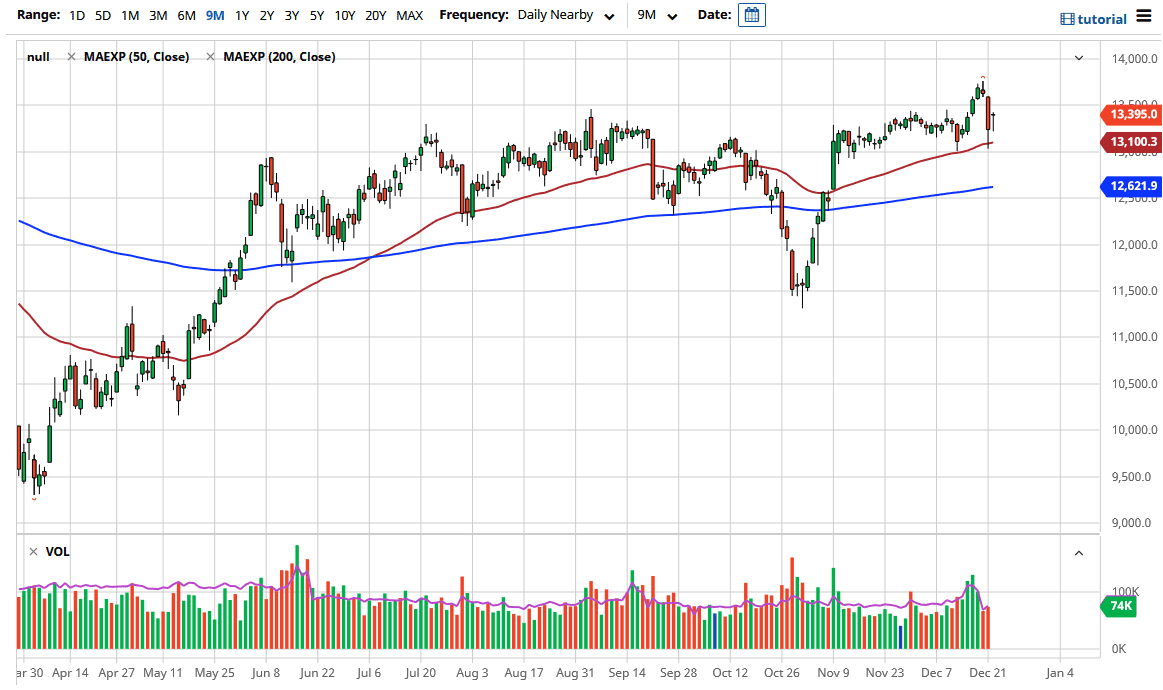

The DAX Index gapped higher to kick off the trading session on Tuesday, fell a bit, and then closed relatively unchanged. This suggests that we will continue to fluctuate and try to figure out what to do next, and the fact that we are going through the Brexit negotiations will not be a huge help. We are currently sitting in the midst of a harami, which means that we could get an impulsive move, but I do not put too much faith into this due to the fact that the market is focusing on the holidays. At this point, the 50-day EMA underneath is at the 13,100 level and sloping higher. Buyers will continue to jump into the market in this area, but I would wait to see some supportive action on a short-term chart before trying to put money to work.

Furthermore, you have to keep in mind that the market is hanging on every word of EU negotiators and their counterparts in the United Kingdom. As long as we continue to have hope of a Brexit settlement, the DAX will probably continue to go higher. To the upside, I believe that the 13,750 level is probably a short-term target, just as the downside has that support at the 50-day EMA, and perhaps even more importantly down at the 12,600 level which is where the 200-day EMA is.

This candlestick is a bit of a hammer, which suggests that perhaps we will continue to go higher given enough time, but I recognize that the DAX is very thin at the moment, and that continues to be a major issue. The longer-term trend is to the upside and we are at a significant resistance barrier from a longer-term standpoint. It looks as if there is a lot of inertia building up under the surface, so if we can break out to the upside it is likely that we could spring much higher. As far as shorting is concerned, I have no interest whatsoever in trying to do so, at least not until we break down below the 200-day EMA. I expect choppy behavior, but ultimately, I favor upside opportunities based upon value more than anything else.