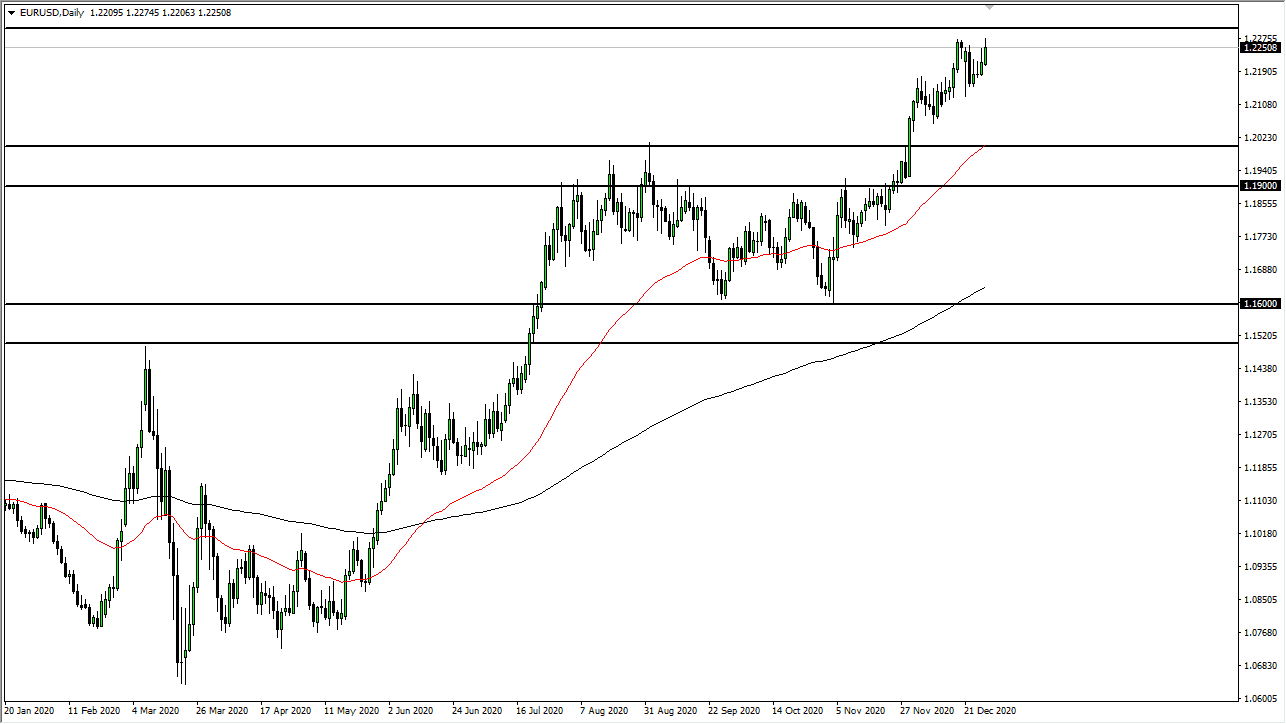

The euro continues to look very bullish, as we saw buying pressure during the trading session on Tuesday. The 1.23 level above is a significant resistance barrier, as we have seen a lot of selling from that level previously on long-term charts. In fact, there is probably a significant amount of resistance extending all the way to the 1.25 level, so a pullback makes sense. Beyond that, we are also looking at the holiday season killing liquidity, so it is very likely that we are going to be quiet and perhaps even struggle to go higher from here in the short term.

We are in an uptrend as of late, and sellers at this point will probably continue to offer opportunities for those seeking value. I believe that the 1.20 level underneath is massive support, as it previously had been so resistive. The 50-day EMA is breaking above there as well, so it is only a matter of time before buyers would come back into the market to try to take advantage of that area.

It is worth noting that the ECB is likely to loosen monetary policy yet again, but there is stimulus in the United States that will continue to push the value of the US dollar lower over the long term. Furthermore, increased stimulus seems to be what we will see in America, so that should continue to work against the value of the greenback as well. The recent impulse has been rather noisy, but resilient when it comes to the upside, so the only thing you can do is try to buy the dips, even if you know that we are getting a bit stretched and could pull back. The next couple of sessions will be very thin, as we have people worrying more about New Year’s Day than anything else. Shortly after that, we will have the jobs number to worry about in America as well, so in the short term, we will stay in a range between the 1.23 level and the 1.20 level. Even if we break above the 1.23 level, it will be very sluggish on the way up to the 1.25 handle. Looking for short-term dips to take advantage of is the best strategy that I see.