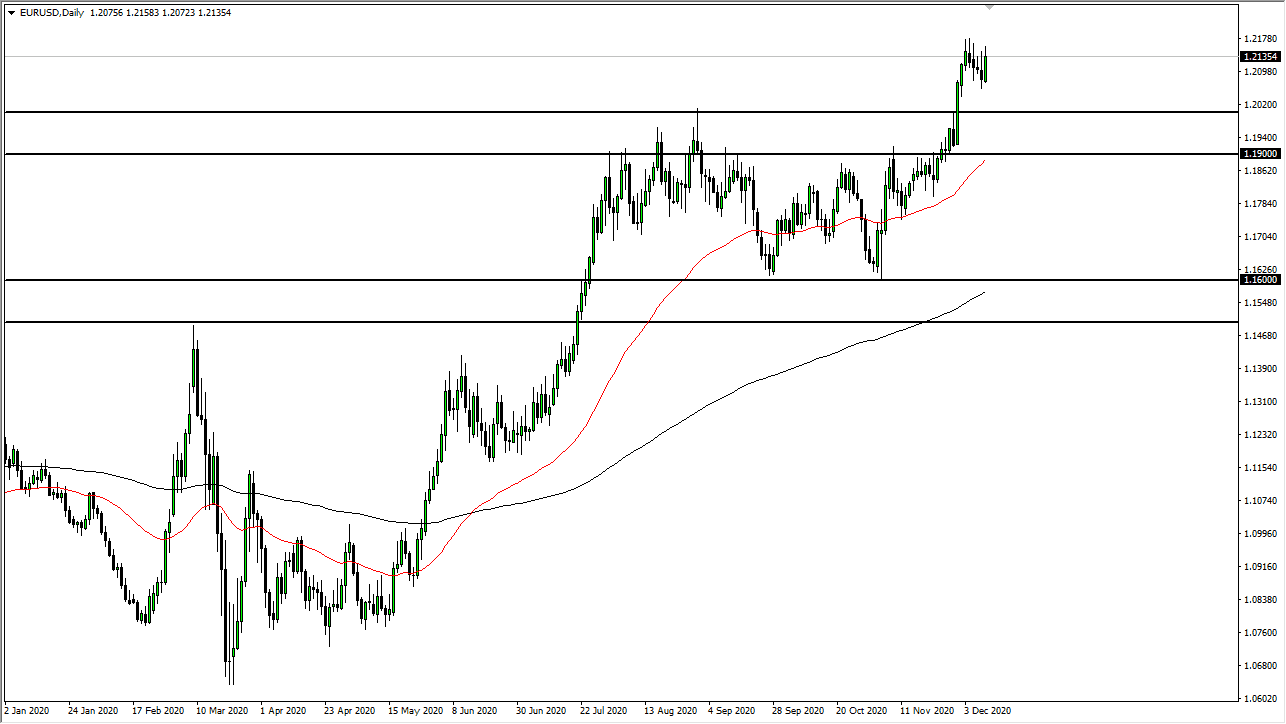

The euro has continued to show signs of strength during the trading session on Thursday as there was a European Central Bank meeting and announcement. Most of what we had seen coming out of that meeting was largely expected, which gave the “all clear” for the euro to continue grinding higher against the US dollar. After all, there were concerns that perhaps Christine Largarde would make an argument about the exchange rate getting a bit ahead of itself, but the lack of overall focus on that has traders buying again.

Furthermore, stimulus talks in the United States continue to press forward, which should bring down the value of the US dollar in general. It does look like we will continue to see the move to the upside and you can even make an argument for a bullish flag. The bullish flag measures for a move towards 1.23 level, which has been my target for some time, so if and when we break out above, we will probably go looking towards that level. Because of this, short-term pullbacks are likely going to be thought of as buying opportunities and I would point out that the candlestick for the day is much more bullish than the ones before it, simply because we are keeping most of the gains. As you can see over the last several sessions, every time we rally, we gave back most of the gains but that is not the case on Thursday.

To the downside, the 1.20 level underneath would be massive support that extends down to the 1.19 level, where the 50-day EMA is starting to reach that region. It is sloping higher, showing signs that the uptrend is starting to strengthen more than anything else. We are looking at a “buy on the dips” scenario, probably extending into the end of the year. This will be especially true if stimulus kicks off in the United States, which is likely to happen. Overall, this is a bullish market and I have no interest in shorting whatsoever as we are so obviously going higher. It looks like the “risk on” trade is very much in vogue.