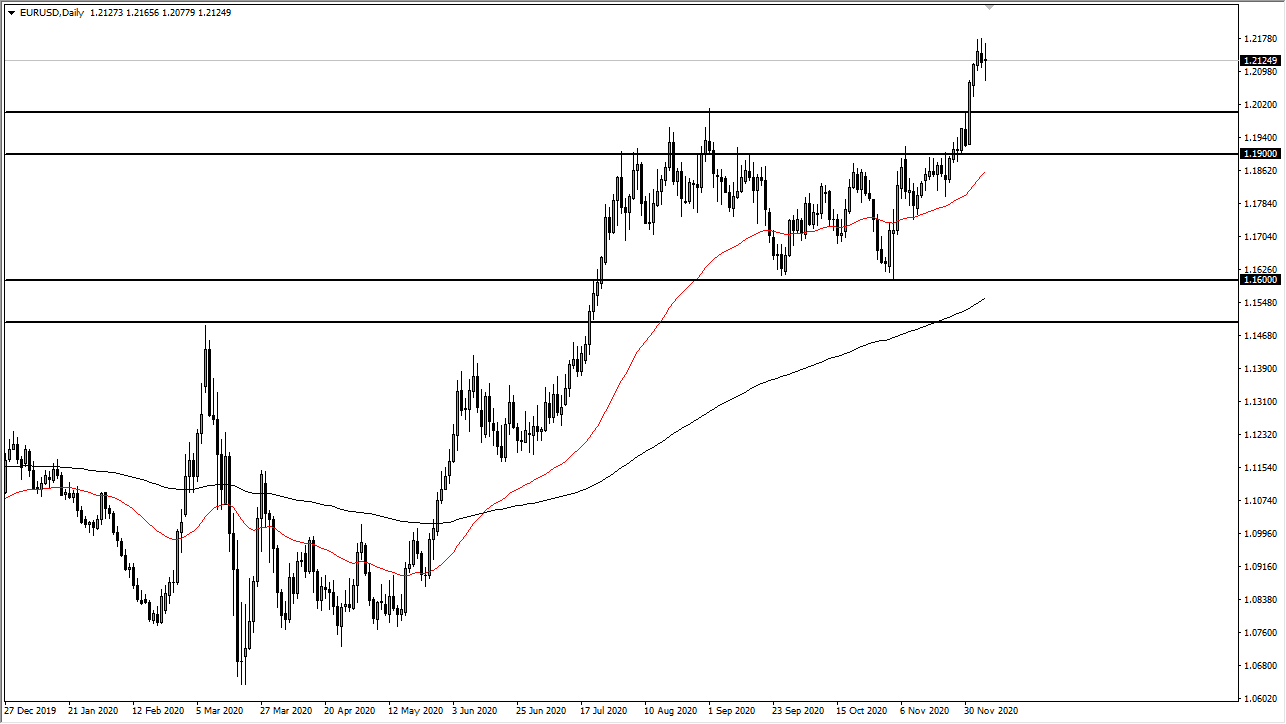

The euro fluctuated during the trading session on Monday, as we continue to see a lot of volatility around the Brexit negotiations. While most people pay more attention to the pound than they do the euro during Brexit headlines, the reality is that both currencies are greatly affected over the longer term by what happens. The market is likely to see a lot of volatility, and it is worth noting that we are a bit over-stretched at this point. The daily candlestick is very confused, which suggests that we will likely see some pullback before all said and done.

That pullback is exactly what we need, so I will look at it with great interest and look to buy the euro closer to the 1.20 level underneath. There is a significant amount of support that extends all the way down to the 1.19 level, and the 50-day EMA is starting to reach towards that level. If it does, then the market is likely to see buying opportunities underneath, as we continue to see buyers jump in regardless. I have no interest in selling the euro, due to the fact that the US dollar continues to fall against almost everything. Furthermore, the Federal Reserve is loosening monetary policy and flooding the markets with liquidity. If there is going to be pullback, one would have to think that there are a lot of people who missed the breakout at the 1.20 level that so many people acknowledge now as a big turn of events.

To the upside, we are still looking towards 1.23 handle, perhaps even further than that. Remember, this pair spends most of its time grinding back and forth, so it is unlikely that we will see a massive move without a Brexit deal. We are still favoring the upside overall, and that is what we need to monitor. I like buying dips, but I also recognize that this will continue to be more of a short-term trading environment going forward.