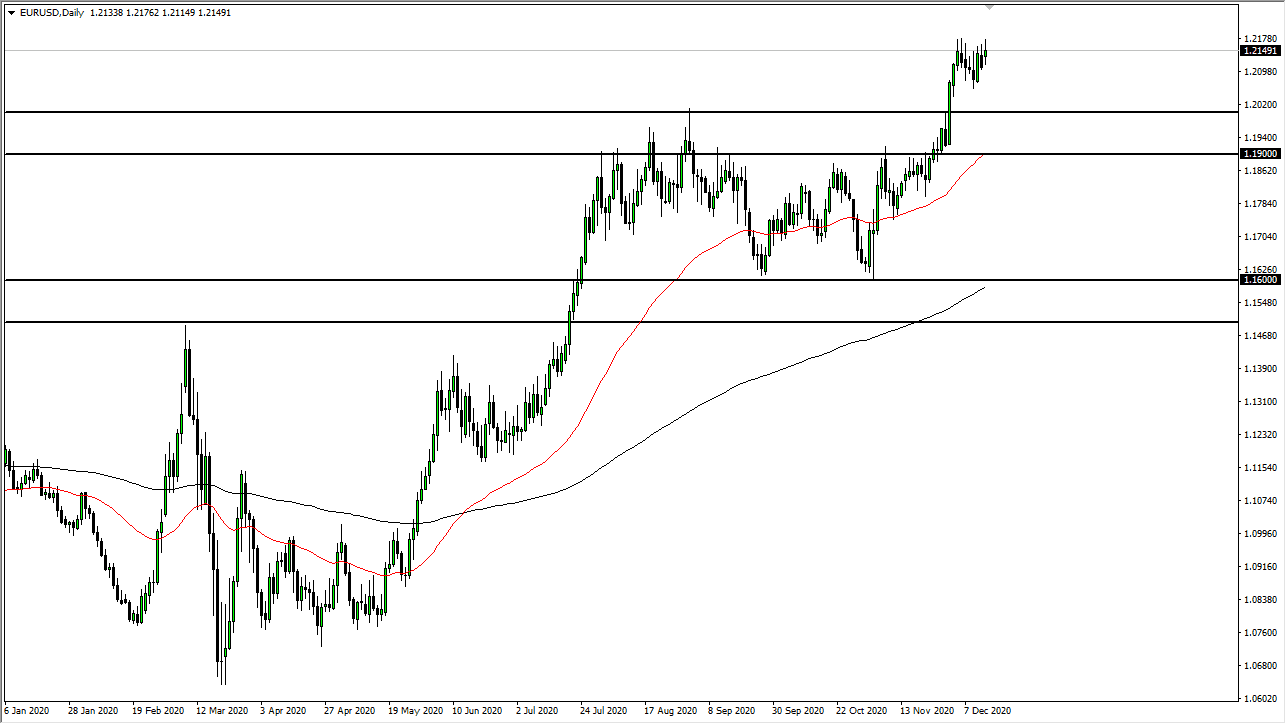

The euro rallied during the trading session on Monday but gave back the gains near the 1.2175 handle, forming a shooting star. This is a rather ugly candlestick that suggests we are running out of momentum. However, I would also suggest that market participants are probably a bit leery about putting a ton of money into this market. The EUR/USD is likely to see buyers on pullbacks though, due to the fact that we have so much bullish pressure underneath and have formed a bullish flag.

To the downside, the 1.20 level underneath is a significant support level that extends down to the 1.19 handle. After that, the market also looks at the 50-day EMA near the 1.19 handle, so it is likely that we will see value hunters in this marketplace, especially as stimulus talks drag on in the United States. The bigger that stimulus package, the more of a significant move to the upside we might get in the euro against the greenback. We are simply trying to grind away some of the massive amounts of gains that we had received in the market, and perhaps take a breather until we go towards the 1.23 level above.

To the downside, the 1.21 handle offers support as well, so that is also an area you may pay attention to if you are a short-term trader. This is about the US dollar and not so much about the euro. The European Union is probably going to have strict lockdowns again, at least in some economies, but others will be reopening. Of particular note is that the Germans are locking down again on Monday, which could cause some hesitation. At the end of the day, however, the thing people are paying attention to the most will be the Federal Reserve. There is no scenario in this market in which I am looking to start selling, so buying the dips is probably how I will be playing the euro in the short term.