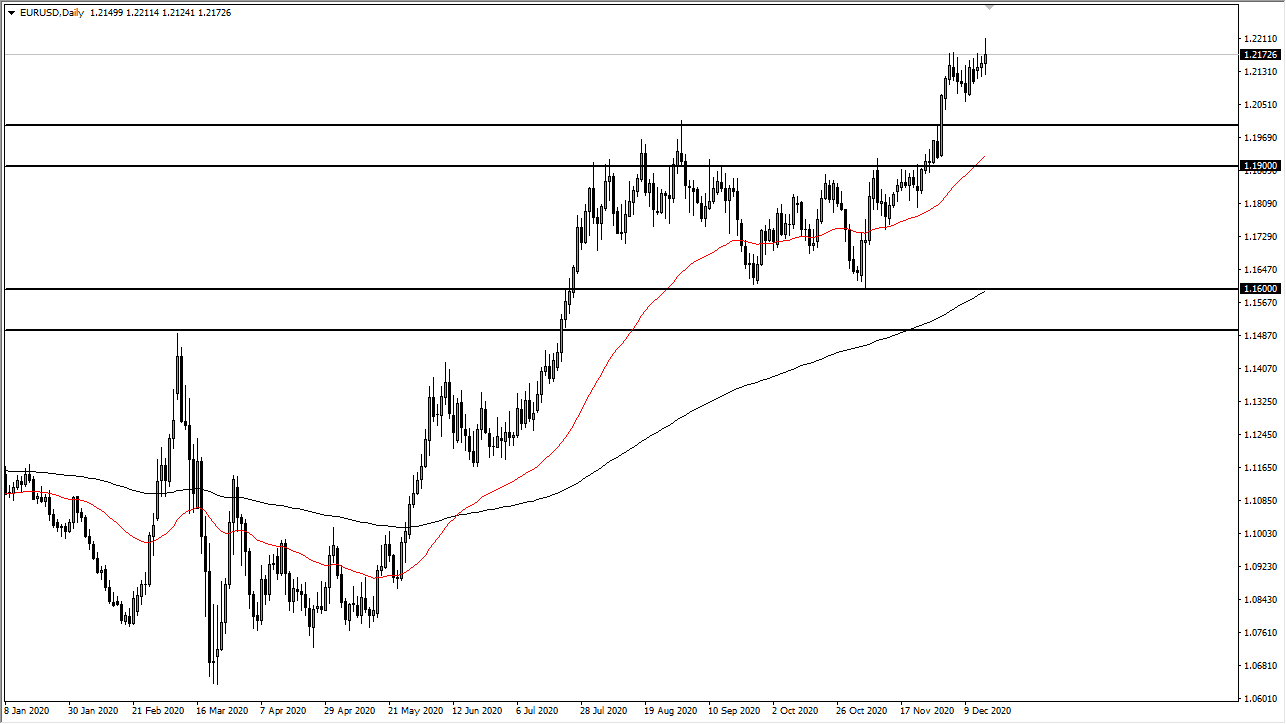

The euro rallied during the trading session but was very volatile, which would be expected on a day when the Federal Reserve and stimulus talks are going on simultaneously. The market is likely to hear a lot of noise in general, and we will continue to see buyers on dips because value hunters will continue to come back into this market. After all, the EUR/USD pair has recently broken out above a major resistance barrier, and it does look like the previous resistance should offer support. The 1.20 level underneath is going to continue offering support, extending down to the 1.19 handle. The 50-day EMA is crashing into that area as well, so I think that will be the floor.

Furthermore, we have formed a nice bullish flag, and it looks likely that we will continue to break out to the upside and see this as a potential target-forming technical formation, with an eye on the 1.23 handle. Looking at the long-term chart is also crucial as well. It seems the 1.23 level has been significant selling pressure in the past and therefore it is the most likely of targets going forward.

The euro will continue to benefit by stimulus coming out the United States, as we are still waiting for reasons to take advantage of the cheaper dollar. The euro probably will continue to see a bit of strength due to the fact that coronavirus numbers are getting worse in the United States while the European Union seems to be dealing better with the outbreaks. We have a lot of volatility ahead going into the next year, so trading is probably going to become much more difficult, not easier. Regardless, I have no interest in shorting this market, at least not until something fundamentally changes, which I do not see happening in the short term. If we can break above the 1.22 level, it is likely that we will see the 1.23 level above.