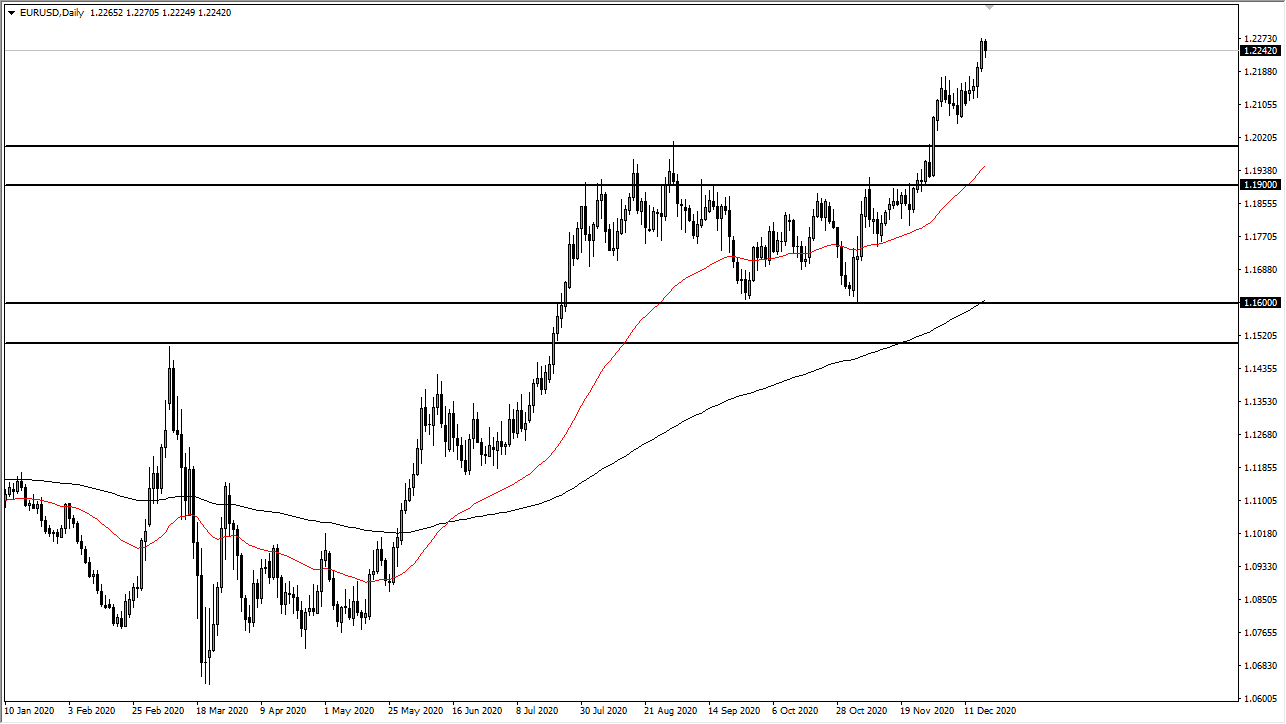

The euro pulled back a bit during the trading session on Friday, but it looks as if we are simply trying to hover and consolidate after a massive explosion to the upside. The 1.2250 level would be an area of significant resistance, extending to the 1.23 level. After that, we could go looking towards the 1.25 level, and then you could probably make the argument that we are over-extended. However, as we have managed to fight off any significant pullbacks, this could be a sign that the euro will simply consolidate and grind to the side in order to digest the recent gains.

Underneath, there is a significant bullish flag that had broken out and has yet to be fulfilled completely. Furthermore, the 1.22 level will be supportive as well, as we had already seen during the trading session. There are plenty of reasons to think that the euro should continue to go higher against the dollar, but a lot of it comes down to stimulus and government officials using the media to air out grievances, which causes more headaches.

The downside is supported by the 1.20 level, and the market is going to have a massive “floor” at that level. We are likely to see more of a “buy on the dips” mentality, just as we have seen for quite some time. This market will have difficulty seeing a lot of momentum, at least for the next several days. Once we get past New Year’s Day, the euro will probably continue to move to the upside. You should thus look at any pullback as a gift, as the trend is very well ensconced in this market, and every time we think the euro is about to roll over, there are buyers who jump in and pick it up. I do not even know that this is a story about the euro itself more than it is a story about the US dollar, which is getting pummeled against almost everything at the same time. We have seen this in gold, silver, crude oil a handful of currencies.