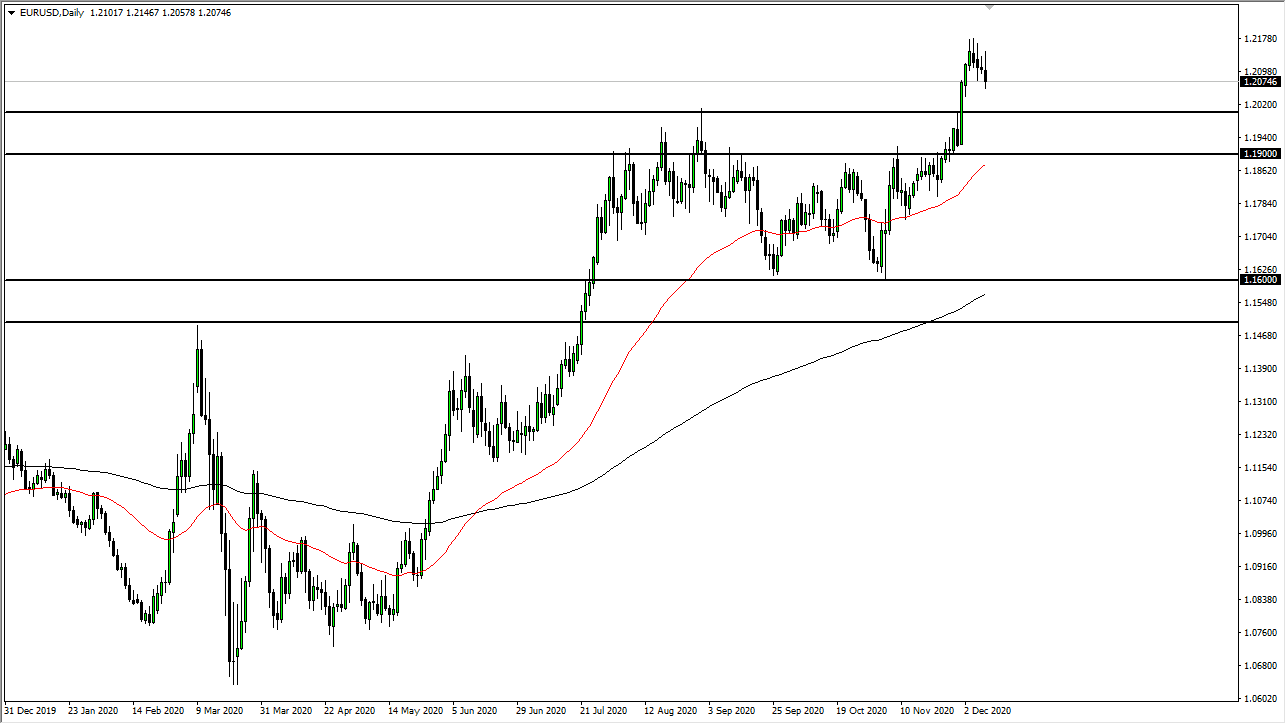

The euro initially tried to rally during the trading session on Thursday as we continue to see bullish pressure, but did give back some of the gains to show that perhaps gravity is coming back into vogue. The 1.20 level underneath will continue to be significant support, based on the fact that it was previously resisted. It was the scene from which we broke out recently, and now it looks as if we are ready to test that level for potential support, perhaps extending all the way down to the 1.19 level, which was the beginning of that zone. But even more interesting about the 1.19 level is the fact that the 50-day EMA sits just below it, which will offer a certain amount of support as well.

Keep in mind that Brexit is still going on, and those headlines could have an influence on the euro, not to mention the fact that the stimulus fight in Washington DC continues to devolve into a playground. The most recent headline was McConnell whining that the Democrats rejected the last two GOP proposals, and the Democrats admitted that they were stalling all throughout summer and fall because of the pending presidential election.

It is clear that we have more drama ahead of us, and that tends to make people cautious about taking risk. If we do not get stimulus, than people may not try to devalue the greenback. I do not think that will be the case in the long term, and eventually they will do what all governments do: spend money. But obviously we have a lot of political posturing to do between now and then. Furthermore, the Senate runoff races in Georgia will keep everything tense as well, not to mention the lawsuit that Texas and seventeen other states have filed with the Supreme Court against the four swing states that have caused so much havoc with the electoral process. I understand that most media are not covering this, but the fact that the Supreme Court has taken up that case makes things all the more potentially ugly.