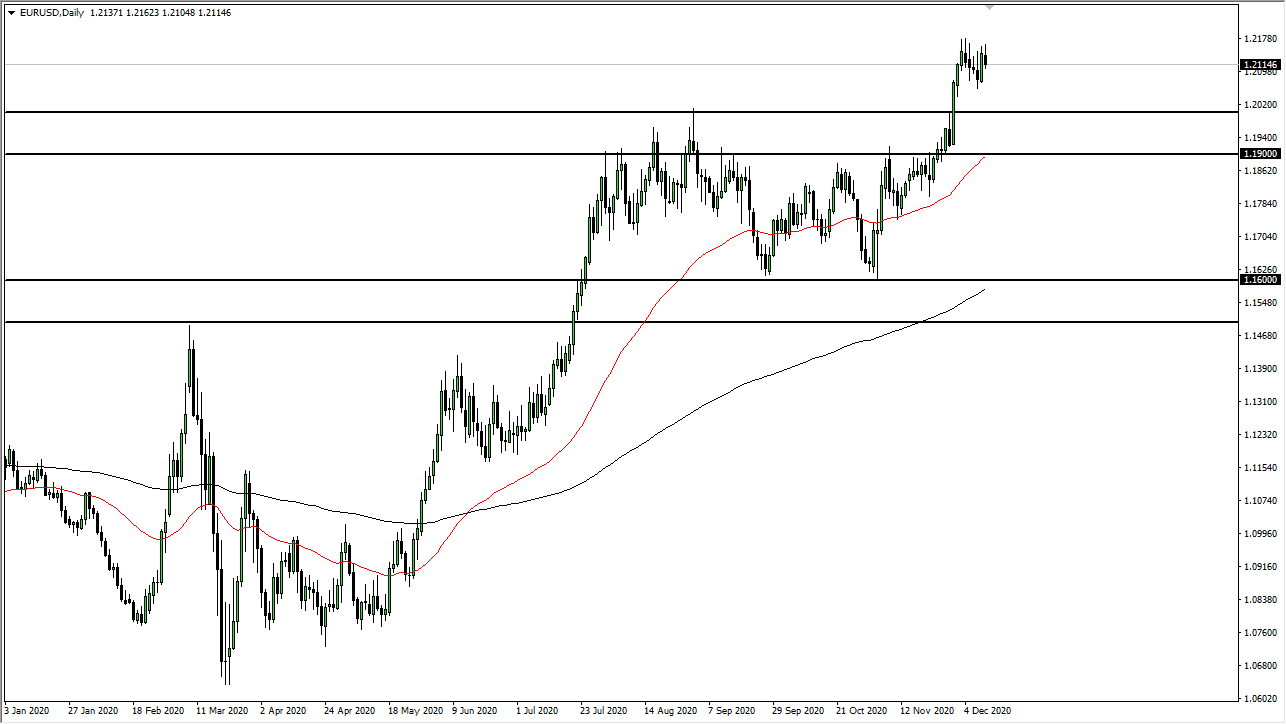

The euro initially tried to rally during the course of the session on Friday but gave back the gains as we continue to see negativity surrounding the Brexit talks. While most people punish the British pound in general, the reality is that the European Union will also struggle if we do in fact see a “no-deal Brexit.” Furthermore, there are budgetary concerns in the European Union as well, so it is very unlikely that we are simply going to see the market take off in a straight line.

To the downside, it is likely that this market will continue to be supported, especially near the 1.20 level which was a massive resistance barrier that we have broken above, and it should now offer plenty of support extending down to the 1.19 level. It is only a matter of time before value hunters will come back into this market, especially as the US dollar seems to be on its back foot in general.

Pay attention to the stimulus talks in the United States, because that is what is going to move the US dollar, which is half of the equation. The question now is not so much whether or not there is going to be stimulus, but how big it will be. The 50-day EMA is starting to reach towards the 1.19 level, and I think that will be your “floor in the market” going forward. To the upside, the 1.23 level is going to be a target given enough time based on the structure of the market, and based on the fact that we have seen a lot of selling in that area. You can also make an argument for a bullish flag from which we are trying to break out, which also measures for a move to the 1.23 level. I have no interest in shorting this market, and a pullback will offer a nice buying opportunity of which many traders will be looking to take advantage.