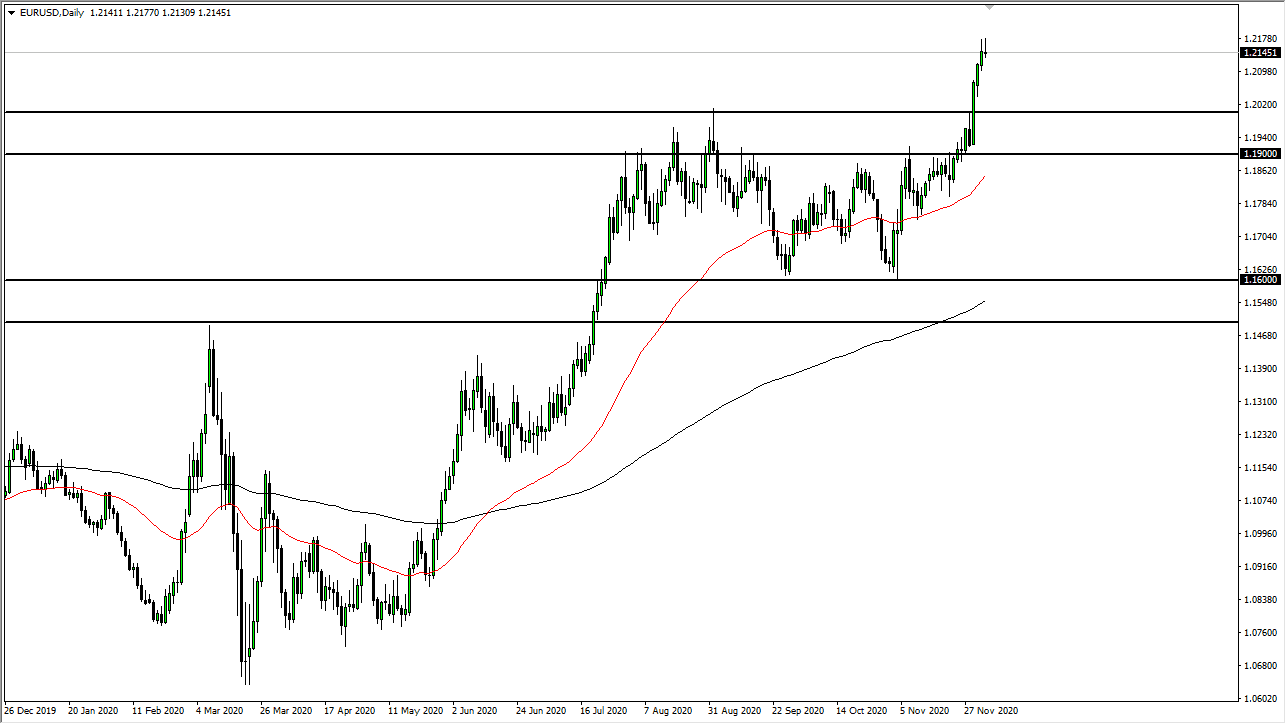

The euro did pullback after initially trying to rally on Friday, as the world awaited the non-farm payroll numbers a Brexit resolution. After all, the market is likely to see a lot of volatility coming out of the Brexit situation, which is likely to be a detriment to the euro, even though it may not be as greatly influenced by it as the British pound will be.

I suspect that the biggest thing here is the fact that we had gotten overextended. Forming a shooting star Friday after the non-farm payroll report is not a huge surprise, considering that we had recently made a major breakout and had not pulled back yet. Monday will probably see a bit of profit-taking as well, especially if we do not get a Brexit settlement. That might be the excuse needed, but eventually we should see buyers underneath and near the 1.20 level. In fact, the closer we get to the 1.20 level, the more likely I am to jump in and start buying.

The alternative scenario is that we will break above the top of the shooting star from the Friday session in what would be an explosive move to the upside. But I would be very hesitant to get overly involved in it, considering that these moves tend to end very violently when we go straight up in the air. It looks like we are very likely to continue the uptrend, but it will be a scenario in which we need to find buyers to continue to drive this pair higher. We quite often will find a retest after a major breakout like this, because the 1.20 level had been so resistance for so long that it took an incredible amount of force to make the move. The US dollar is obviously on its back foot, so even if you told me that the market was definitely going to fall on Monday, I still would not be a seller; I would simply wait for a better opportunity to start buying underneath, as this move a few days ago was so important.