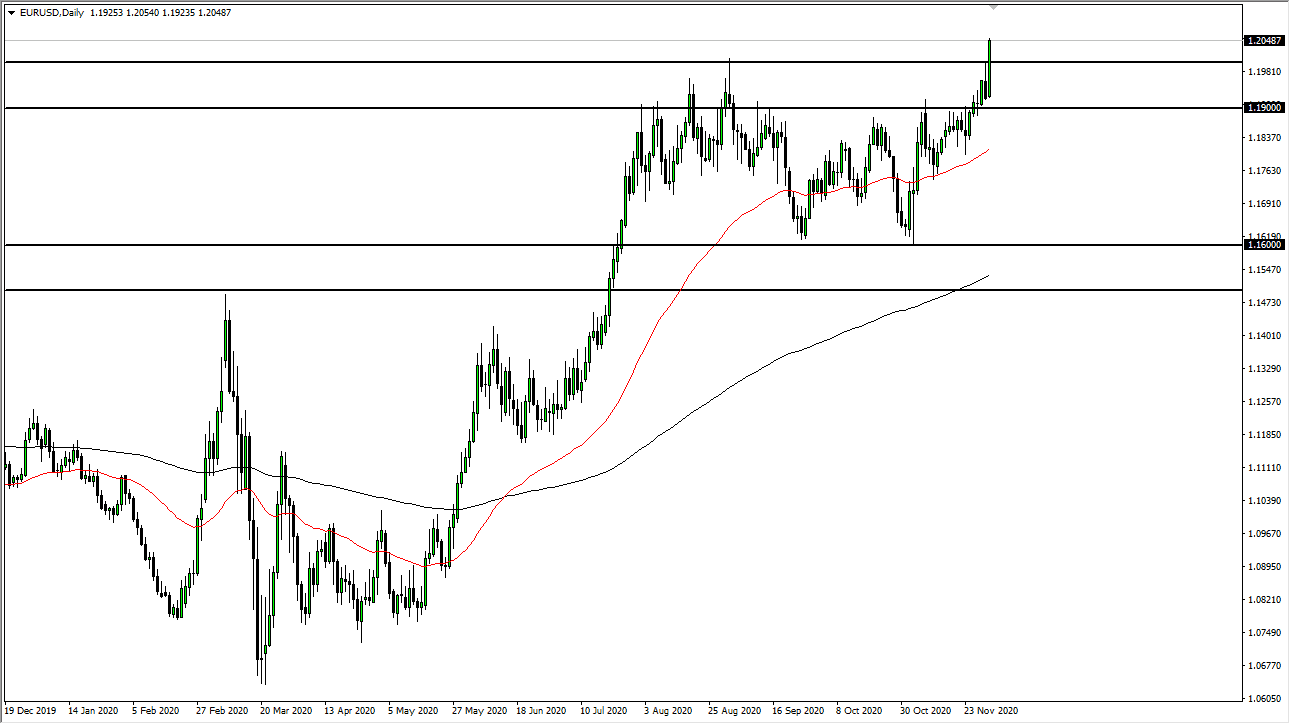

The euro broke above the 1.20 level during the trading session on Tuesday as a major barrier has now been broken through. It looks as if the euro is finally going to take off, as the level has been difficult to break above for some time. Now that we are above there, the euro could take off towards the 1.23 level based on the projected move.

We have been in a massive “W pattern”, and it seems the Americans are about to go full bore on stimulus, especially with the Biden administration jawboning it during the day. It is obvious that the euro is something you should be buying on dips, with the 1.20 level very likely being a major support level. It's difficult to imagine shorting this pair, unless things suddenly change for the United States. Now that we are above the 1.20 level, people will be paying attention to the European Central Bank, but although the bank had taken the currency lower from the 1.20 level previously, the trade-weighted euro has not been skyrocketing, so they may be okay with the idea of it rising against the US dollar.

Furthermore, we have the Federal Reserve doing everything it can to bring down the value of the US dollar, and the Federal Reserve typically gets what it wants. The market is likely to see a lot of fluctuation, but clearly there is a lot of momentum and, when you look at the massive “W pattern”, breaking above this is a big deal. Most longer-term traders will be trying to eyeball the 1.23 level, possibly even the 1.25 level as well.

The size of the candlestick is rather impressive, so there probably will be a significant amount of follow-through eventually, especially if the Americans are going to flood the market with dollars. Liquidity measures will almost certainly be taken one way or another, and now the US government is starting to talk about stimulus for citizens as well. That should in theory flood the market with greenbacks also. With this, it looks as if the euro has further to go.