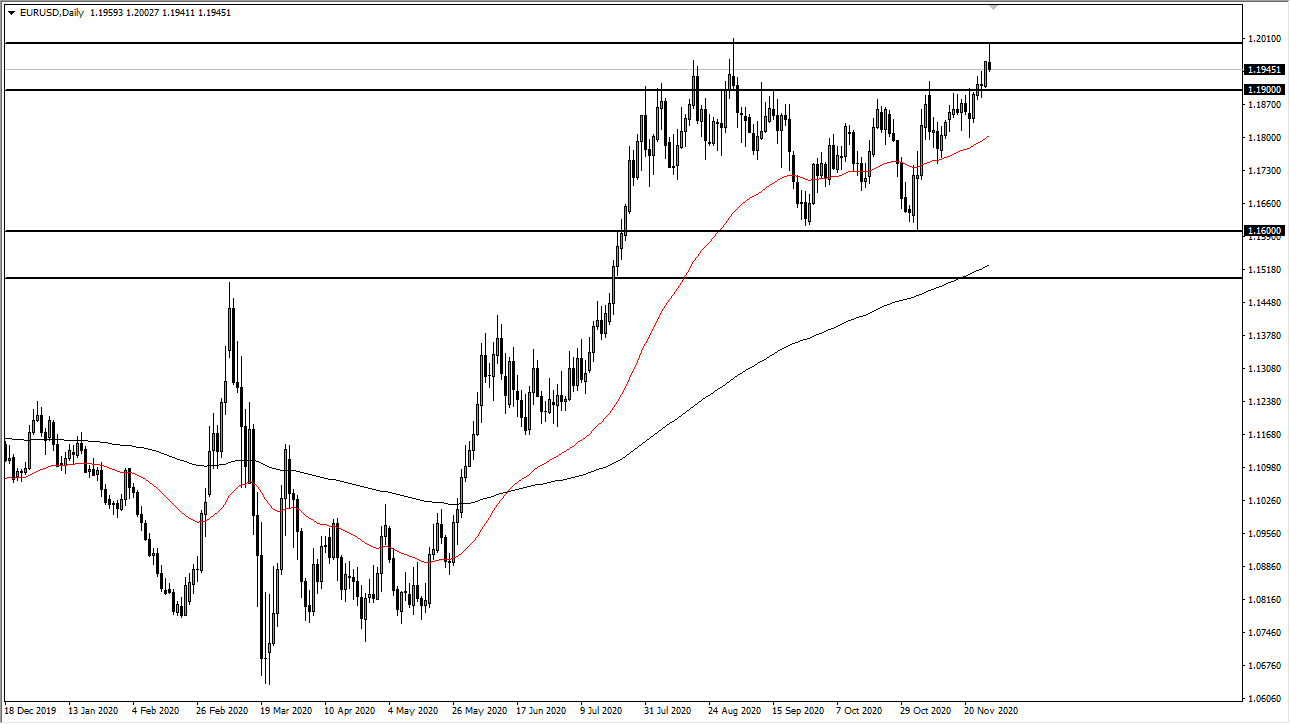

The euro tried to get above the 1.20 level during the trading session on Monday, but gave up the gains as the “London fix” started. This was heavily pro-US dollar as managers had to rebalance their portfolios. It has formed a rather ugly candlestick for the euro, but we are still very much in a strong uptrend. It is not so much about whether or not we could pull back, but whether or not the trend is broken. We clearly have not broken the uptrend. This does not mean that we won't pull back rather hard. However, at the very least, the 50-day EMA will be supportive. It is only a matter of time before we will continue to go much higher.

If we break above the top of this reversal candlestick, that would be very bullish and could send the euro going towards the 1.2350 level. In fact, I'm banking on that, but I recognize that I may be able to buy the euro at cheaper pricing at this point. It is worth noting that almost as soon the selling abated from the London fix, the market essentially sat still. That means that there was no real follow-through with selling pressure, which tells me that it probably had very little to do with whether or not people wanted to buy US dollars, but rather something to do with the fact that they had to.

It is difficult to imagine a scenario in which the euro would fall apart at this point, mainly because it has been so relentless in its move higher. Furthermore, you are seeing other higher beta currency, such as the Canadian dollar and the Australian dollar, try to break out against the greenback as well. Again, this is not necessarily a question of whether or not it can happen, but more or less when it will happen. Pullbacks should continue to offer buying opportunities and that is exactly how you should look at them. As long as we can stay above the 1.19 level, I do not know that much will have changed during the course of the day.