During last week’s trading, we noticed a strong struggle between bulls and bears in determining the path for the EUR/USD pair, which closed the week’s trading around the 1.2112 level. The strongest gains were at the 1.2163 resistance, and the lowest levels of support were at 1.2058. There were many factors that supported this performance, including investor optimism with the beginning of coronavirus vaccinations and the European Central Bank's expansion of stimulus plans with its pledge to monitor the exchange rate after recent euro gains. On the other hand, differences increased among European leaders over the presentation of the emergency stimulus plans necessary to revive the European economy, in addition to the stalled Brexit negotiations.

The EUR/USD pair dropped at the end of last week’s trading after investors reacted to US inflation figures. It appears that the pair is on its way to complete the XABCD double top reversal pattern. It is now stable at the 100-hour simple moving average while the 200-hour simple moving average is a few levels below. The recent pullback prevented the pair from crossing to overbought levels of the 14-hour RSI on the hourly chart and, as such, it is now positioned centrally in the RSI.

The European Union finally approved a budget of 1.1 trillion euros and a coronavirus recovery fund of 750 billion euros. Also, the European Central Bank kept the benchmark interest rate unchanged at 0.0% while the deposit rate remained steady at -0.5%. The EU GDP growth reading in the third quarter came in below the expected (quarterly) rate of 12.6%, with a change of 12.5%. On an annual basis, the output was recorded at -4.3%, and expectations were at -4.4%.

Monetary policy makers of the European Central Bank kept all major interest rates unchanged after their December meeting, in line with analysts' expectations, but agreed to expand the bank's quantitative easing program related to the coronavirus. The rates charged or paid on the ECB's major refinancing operations, the marginal lending facility and the deposit facility remained unchanged at 0.00%, 0.25% and -0.50%, respectively. This was despite the fact that the allocation to the newly created Pandemic Emergency Purchase Program (PEPP) increased by 500 billion euros for a total of 1.85 trillion euros.

The European Central Bank has also modified a set of other tools amid the second wave of coronavirus infections, which has seen all major European economies placed under varying degrees of renewed "lockdown" this quarter.

Earlier, there were concerns in the markets about what the European Central Bank might do in order to stem the euro gains. That was a successful way to keep the EUR/USD pair trapped below the 1.20 level for a large part of the time between early September and early December when it was finally crossed.

In general, the Eurozone will enter a double-dip recession if the economy shrinks again in the first quarter of 2021. Economists have always said that this is unlikely, although it is more than that now given the early stage of the launch of the coronavirus vaccinations from Pfizer and Biotic, which started in Britain last week and will soon expand to other countries as well. Therefore, the introduction of the vaccine is expected to boost the global economic recovery already expected in 2021, which will raise the euro again to levels last seen in 2014 in some cases.

The preliminary Michigan Consumer Confidence Index for December beat expectations of 76.5, with a reading of 81.4. On the other hand, the US PPI reading excluding food and energy for the month of November was below expectations of 1.5%, with a change of 1.4%. On a monthly basis, a change of 0.1% was recorded and expectations were of 0.2%. In contrast, the previous US Consumer Price Index for food and energy for November surpassed expectations (monthly) at 0.1% with 0.2%, and on an annual basis, it came as expected by 1.6%.

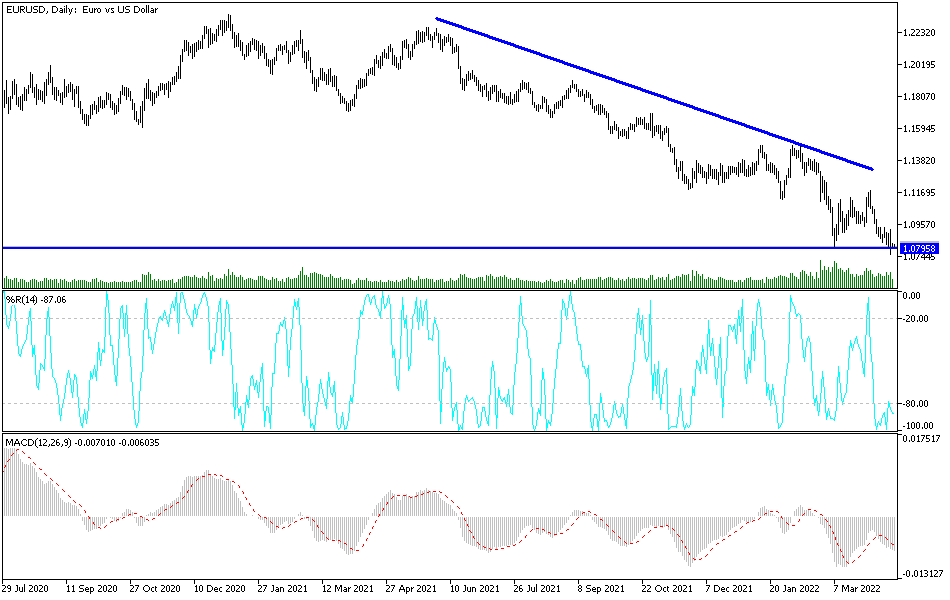

Technical analysis of the pair:

In the near term, and according to the performance on the hourly chart, it appears that the EUR/USD pair has recently declined to stop a sharp rally. The pair is now on its way to complete the XABCD double top reversal pattern after Friday's pullback. Accordingly, bulls will target short-term retracement gains around 1.2134 or higher at 1.2161. On the other hand, bears will be looking for profits around 1.2089 or lower at 1.2074.

In the long term, and according to the performance on the daily chart, it appears that the EUR/USD is trading in a steep upward curve amidst strong upward pressure. The pair has recently pulled back to halt its rally. It is now closer to the normal 14-day RSI trading territory after hitting overbought levels. Accordingly, bulls will look to extend the current long-term gains towards 1.2176 or higher at 1.2242. On the other hand, bears will target long-term pullbacks around 1.2057 or lower at 1.1987.