The increasing pressure on the US dollar gives the EUR/USD an opportunity to continue achieving stronger gains. The pair tested the 1.2235 resistance, where it is stable at the time of this writing, and is the highest level for the currency pair since April of 2018. Risk appetite is present amid the possibility of more stimulus for the US economy to face record numbers of coronavirus infections. European countries, led by Germany, started imposing new lockdown restrictions to contain the second wave of the outbreak before Christmas.

This situation contributed to the IFO lowering its economic growth forecast in Germany for 2021. The IFO Research Institute said yesterday that the German economy is expected to recover at a slower pace than expected earlier, due to the resurgence of the coronavirus pandemic and the second lockdown to slow it. In its winter forecast, the institute lowered its growth forecast for Germany for next year to 4.2 percent from the 5.0 percent forecast in the fall forecast.

The largest economy in the Eurozone is expected to contract by 5.1 percent this year, which is slightly less than the 5.2 percent contraction we saw earlier. IFO raised its growth forecast for 2022 to 2.5% from 1.8%. "The recent closures in Germany and other countries are pushing the recovery back," the IFO said.

Production of goods and services will not reach pre-crisis levels until the end of 2021. '

From the United States of America, the US central bank kept US interest rates unchanged close to zero, with an emphasis on keeping them there for a longer period. The bank is determined to increase the stimulus plans with new and expanded purchases of bonds, and is still calling on Congress to speed up the passage of more stimulus plans. Stimulus may save the US labour market and encourage ]consumer spending, which represents 70% of the economic activity of the United States of America.

Global stock markets led by the US remain buoyed by hopes that Congress will finally provide fresh aid to help US companies and families cope with the pandemic. On Wall Street, the S&P 500 Index approached a record high after the Federal Reserve pledged to continue buying bonds until the US economy makes significant progress from the devastating effects of COVID-19. In general, it appears that congressional leaders are on the verge of approving an economic aid package for COVID-19 that would provide assistance to individuals and companies and ship coronavirus vaccines to millions.

Negotiators are working on a $900 billion package that would revive subsidies to companies hard hit by the pandemic, help distribute new vaccines, fund schools and renew unemployment benefits that will soon expire. They are also looking to include new direct payments of around $600 for most Americans.

Aid to the US economy is seen as essential to the global economy and many exporters are dependent on US demand to keep their own factories running. But optimism about a potential deal after many false starts faces concern about the resurgence of coronavirus cases in many Asian regions at a time when vaccines began to spread around the world led by the Pfizer vaccine.

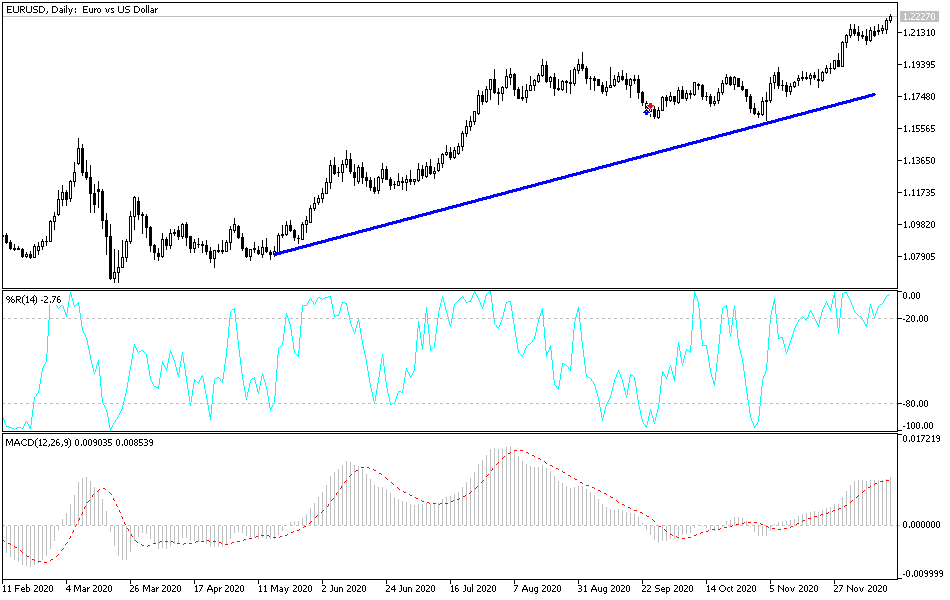

Technical analysis of the pair:

On the daily chart, the price of the EUR/USD is still in the range of a bullish channel, and the pair's continued neglect of the technical indicators reaching strong overbought areas may push it towards the next most important resistance level at 1.2415. On the downside, there will be no real reversal of the trend without breaking below the 1.2000 support. So far, I still prefer selling the pair from every upward level. The currency pair today awaits the announcement of inflation figures in the Eurozone. In the United States of America, data include the housing market numbers, building permits, housing starts, and then reading the Philadelphia Industrial Index and the weekly jobless claims.