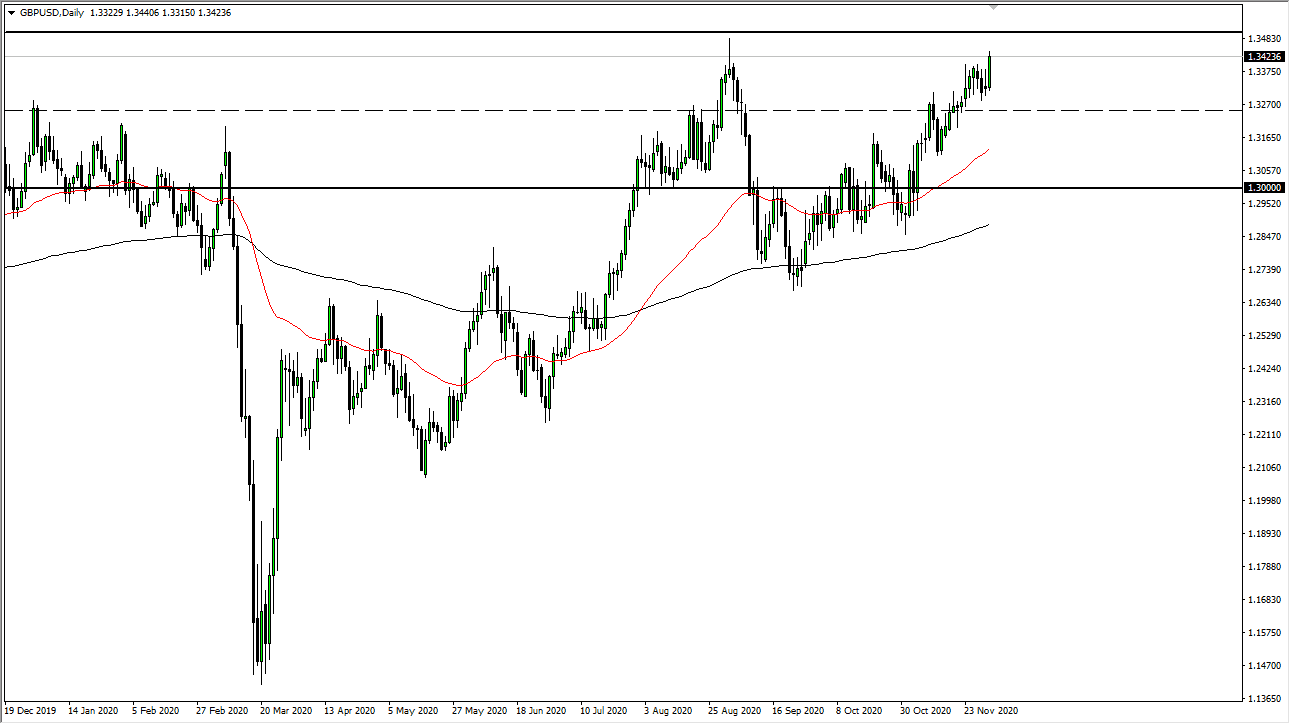

The British pound rallied significantly during the trading session on Tuesday to break above the 1.34 level which has been resistance over the last week or so. It looks as if the market is trying to go to the psychologically and structurally important 1.35 level as we wait to see whether or not the EU and the UK can get it together. Market participants are starting to price in a high probability of a Brexit deal, so the British pound continues to be rather supportive.

It appears that the 1.33 level should be supportive, so it is likely that traders will buy into pullbacks - unless the Brexit situation suddenly gets ugly. Even if it does, I suspect that there will be plenty of value hunters down there trying to pick up value in the British pound, as it has been so beaten down over the last couple of years. By some estimates, the British pound is undervalued by roughly 15% of its normal weight.

The size of the candlestick is somewhat impressive, considering how small some of the other ones were over the last couple weeks. Now we are simply waiting for a decision over the next day or two as to where to go next - not just regarding the British pound, but all things Brexit-related. If we do break above the 1.35 handle, the market is likely to go much higher, perhaps reaching towards the 1.3850 level given enough time. However, it is very likely that what we will see is a move towards the 1.40 level. While this is a market that will go much higher over the longer term, it will continue to be difficult to handle some of the volatility eventually. As far as selling is concerned, I have no interest in doing so. The British pound has been so resilient over the last few months, and every time we get sellers, people come in trying to pick up value as so many people are trying to get in ahead of the breakout.