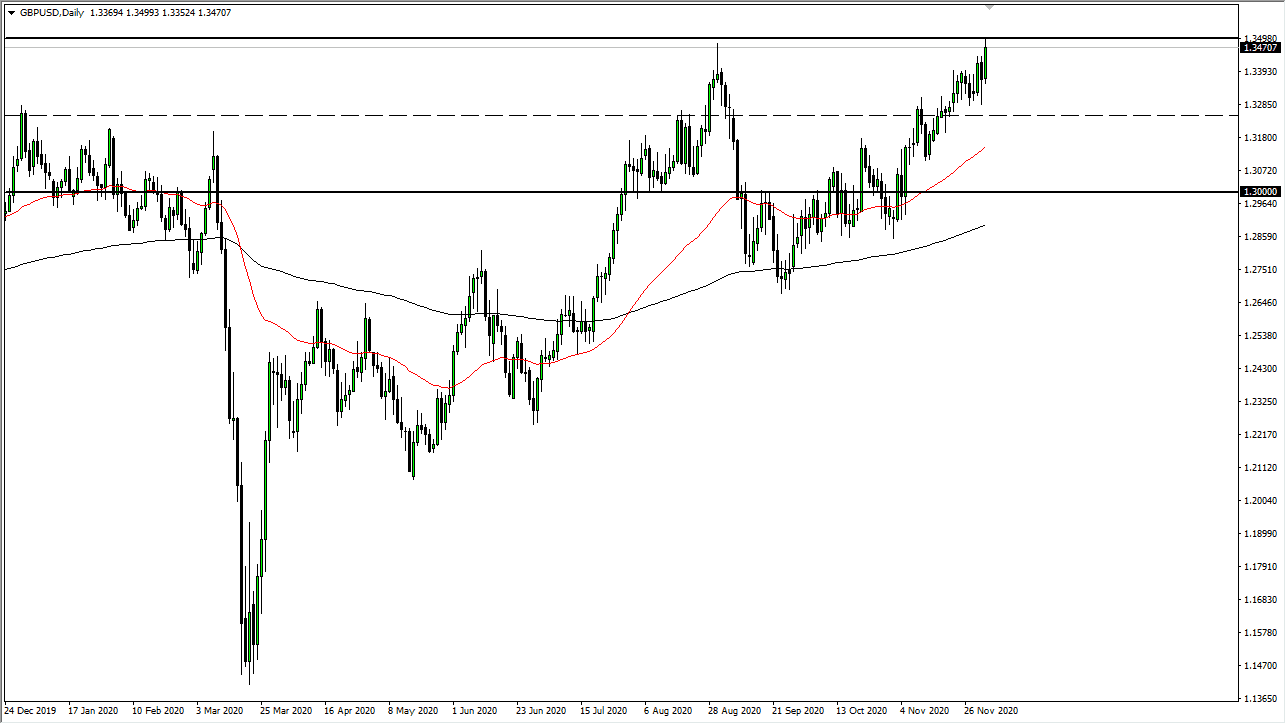

The British pound has rallied rather significantly during the trading session on Thursday as traders are anticipating some type of Brexit deal coming out in the next few days. With this, the British pound has reached towards the 1.35 level, an area that of course will attract a certain amount of attention due to the fact that it is a large, round, psychologically significant figure. With that being the case, I do think that it is only a matter of time before we break out above there and am expecting a significant move afterwards.

That being said, we did see a negative reaction as some downbeat comments came out of the meeting between the United Kingdom and the EU. However, it looks as if the market is trying to stabilize at this point and it is very likely that we will continue to see the market force the issue. At this point in time, most people believe that there is some type of an agreement coming, and therefore when the British pound dips, people are buyers.

If we do break above the 1.35 handle, that could open up a move to the 1.38 handle rather quickly. Beyond that, my next target would be 1.40, followed by 1.43. Yes, I understand that these are huge moves, but the reality is that the British pound is rather cheap from a historical standpoint. If they get some type of level playing field agreement, that could be all it takes to send the British pound much higher, especially considering what the Federal Reserve and the US government is currently doing on the other side of this trade. The US dollar is clearly on the back foot, so this could only be positive for Sterling if we do get some type of an agreement. Do not be wrong, I do not necessarily think that it is going to be easy but clearly that is the direction that the market is trying to go.

As if Brexit was not a big enough issue, we get the Non-Farm Payroll numbers coming out on Friday, and that of course will throw some volatility into the mix as well. Ultimately, I do think that this is a market that will find an excuse one way or the other to go higher, but we may get a short-term pullback in the process of doing so.