The British pound had a relatively choppy month in December as we finally got over the finish line when it came to the Brexit situation. Now that the deal is signed, traders will start to think about other situations, and it will be interesting to see what we focus on next. I suspect that at this point, we will start focusing on the actual economy itself in the United Kingdom, so people will start to focus on coronavirus lockdowns and the like. This could lead to a tough outlook for the British pound, but we have escaped the “worst case scenario.”

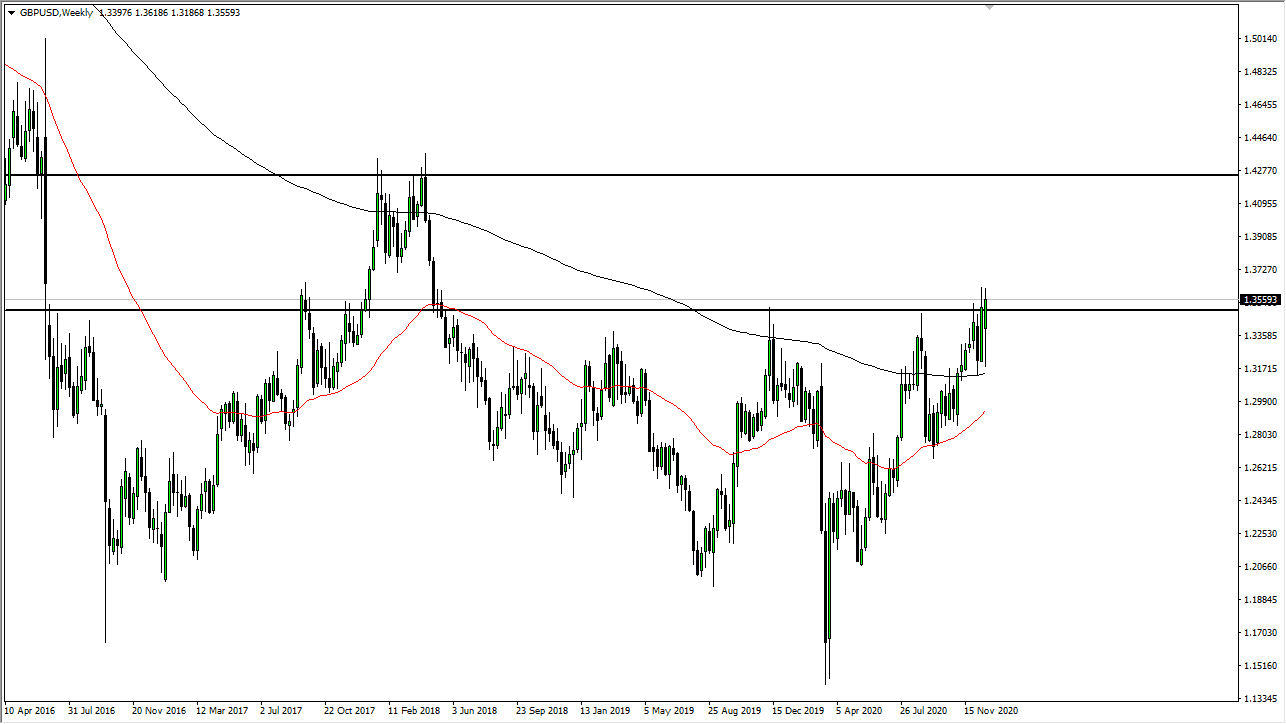

The market is likely to still try to rise over the course of the month of January, but the gains from here will be much more limited than they have been for the past year. In other words, the “easy money” has already been made. Granted, it is a bit difficult to think of it as being “easy”, but clearly the move has been to the upside. We will probably try to make a move towards the 1.3750 level, but then start to see selling pressure come back. After all, the coronavirus lockdowns in the United Kingdom will do significant damage to the economy.

The only thing that will be for sure over the next several weeks is that we will have to “reset our expectations” when we look at the British pound. But one thing that you can take away from what we have seen is that the British pound is still extraordinarily cheap from a longer-term perspective. This does not necessarily mean that we can expect it to go straight up in the air, but one thing that I think will lift this market more than anything else will be the Federal Reserve and its loose monetary policy. It is hard to tell whether or not that will be enough, but clearly the Federal Reserve will do everything it can to bring down the value of the US dollar. I think that the month of January is going to be very choppy, with a bottom somewhere near the 1.32 handle, and a top somewhere near the 1.3750 level. I would anticipate a lot of short-term back-and-forth more than anything else.